TOMATO CATCH-UP - Newsletter Issue 253 – January 2023

Your monthly resource on working capital, process optimization, and issues related to the world of corporate treasurers, IT professionals, and bankers!

This newsletter is bilingual, English or German, depending on the source.

Introduction

In a new year that seems again unpredictable, a dose of pragmatism and more realistic solutions in business and our personal lives are needed more than ever. With this in mind, here at Tomato we’re starting the new year by inviting you to discover and draw inspiration from the six 2023 resolutions for leaders by Forbes:

- Make 2023 the year you ‘do good’

- Make time for a ‘well-being audit’

- Set and role model a healthy pace

- Make time to daydream

- Use more lateral thinking (approach problems from a different angle)

- Make 2023 the year your resolutions actually stick

After reading the articles in Forbes once again I found a space in our office to daydream three times since January 1st and worked out on the rowing machine here. I am determined to keep these habits and not end up as a "New Year's resolution" that sounded good but petered out ;-)

This month’s Catch-Up includes topics such as The Most Read Articles in 2022, Cybersecurity Upgrades, Managing Software Teams, Technical Debt on Cloud, Economy Education, ISO 20022, SEPA Order Data, and more.

Remember that for any challenge related to your financial issues, you can ask Martin Schneider for a discussion that will clarify it. Contact Martin via email or call +41 44 814 2001.

- The Most Read Articles in Our Newsletter in 2022

- Banking Flat Fee: How to Enter Into Qualified Negotiation

- PwC Survey: (Swiss) Companies Upgrade Their Cybersecurity?

- Cloud Migration: How to Reduce Technical Debt

- Target2: RTGS-Zahlungen Übergang zu ISO 20022

- Deutsche Kreditwirtschaft ISO-File V2.7

- ThomaBravo Owns Now Coupa/tm5

- Book Tip – Managing the Unmanageable: Rules, Tools, and Insights for Managing Software People and Teams

- Termine & Events

- From the Desk of Tomato

1. The Most Read Articles in Our Newsletter in 2022

What interested our newsletter readers most in 2022?

Here’s the list of the top 10 most-read articles (in German or English) of our 2022 Tomato Catch-Up:

- January: Treasury Gehälter in DE und CH

- February: Schweizer ISO XML: Änderungen für Nov-2022

- March: Webshop: Processes and Integrations from Tomato

- May: 30 Years Anniversary Interview

- June: Entwicklung der Steuerbelastung Schweizer Gemeinden seit 1995

- July - August: BNP – Currency Guide for Treasurers

- September: Die besten Banken im Deutschen Firmenkundengeschäft

- October: Löhne von Fachkräften in der Schweiz – was Spezialisten und Fachleute in der Schweiz verdienen, Bericht von Handelszeitung und Kienbaum.

- November: Durchbruch für Sofortzahlungen in Europa? – über das Ziel der EU-Kommission, Echtzeitzahlungen zum Standard zu machen.

- December: Veränderungen im TMS-Markt – die Ergebnisse einer von DerTreasurer durchgeführten Befragung von 70 Treasury-Experten über die Aussichten auf dem Markt für Treasury-Software.

2. Banking Flat Fee: How to Enter Into Qualified Negotiation

Do you receive a fee for each bank transaction similar to how each telephone call used to be listed individually on the bill?

There is a way out of the endless, time-consuming control work: negotiate flat bank fees!

The most important point is: don't expect bank fees to become cheaper than they were before. The key to saving time and money is on the corporate side! The time accounting departments spend reviewing bank charges and eliminating discrepancies is enormous.

Continue reading at Tomato Publications

Ziehen Sie Deutsch vor?

Möchten Sie pauschale Bankgebühren? Erhalten Sie für jede Banktransaktion eine Gebühr? Ähnlich wie früher jedes Telefongespräch einzeln auf der Rechnung aufgeführt wurde?

Es gibt einen Ausweg aus den endlosen zeitraubenden Kontrollarbeiten: Pauschal verrechnete Bankgebühren!

Der wichtigste Gedanke ist: Erwarten Sie nicht, dass die Bankgebühren billiger werden als bisher. Wenn Sie diese Vorstellung überwunden haben, wird Ihr Buchhaltungsleben viel einfacher.

Der Schlüssel zum Sparen von Zeit und Geld liegt auf der Unternehmensseite! Die Zeit, die Buchhaltungsabteilungen mit der Überprüfung von Bankgebühren und der Beseitigung von Diskrepanzen verbringen, ist enorm.

Lesen Sie weiter bei Tomato Fachberichte

3. PwC Survey: (Swiss) Companies Upgrade Their Cybersecurity?

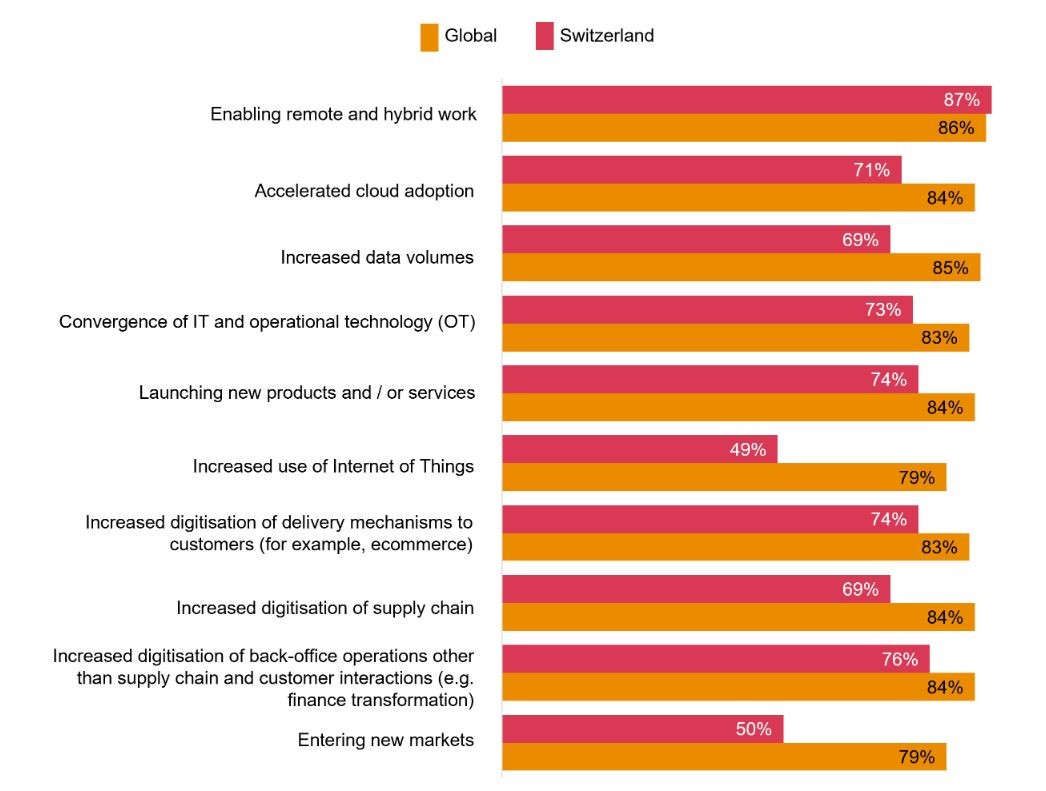

The findings from the PwC 2023 Global Digital Trust Insights survey of over 3,500 business, security, and IT leaders in more than 60 countries conducted in summer 2022 show that cybersecurity has become a dynamic field that is rapidly changing to keep pace with recent years’ events.

According to the survey, Switzerland is lagging behind, especially in terms of cloud adoption and the risks associated with the use of the Internet of Things (IoT):

Respondents:

- are based in: ~50% in Western Europe (31%) and North America (28%), followed by Asia Pacific (18%), Latin America (12%), Eastern Europe (5%), Africa (4%), and Middle East (3%)

- operate in these ranges of industries: Industrial manufacturing (24%), Tech, media, telecom (21%), Financial services (20%), Retail and consumer markets (18%), Energy, utilities, and resources (9%), Health (5%), and Government and public services (3%)

- are by 52% are executives in large companies ($1 billion and above in revenues); 16% are in companies with $10 billion or more in revenues.

- 84% of respondents worldwide say they have accelerated cloud adoption, but only 71% in Switzerland; > important see also the hurdles on our article no 4

Here the information for Swiss corporates

- 79% reported significant progress in mitigating IoT risk, but only 49% in Switzerland;

- 50% of Swiss respondents have fully or moderately mitigated cyber risks associated with entering new markets, while globally 79% have done so.

Quick findings in the graph below:

Donwload the full PwC survey free of charge by giving your credentials.

4. Cloud Migration: How to Reduce Technical Debt

The myth of lift’n shift: Engelbert Epple, Lead Architect in large Cloud-Migration projects (especially SAP2Cloud), shares his experiences related to moving large enterprises to the Cloud. Engelbert is also a long time reader of the Tomato Catch-up News.

Engelbert uses the term “Technical Debt” to describe what enterprises currently do when they move their IT to the Cloud. On one hand, there are hyperscaler’s (AWS, Microsoft Azure, or Google), who allow them to save money when moving their entire infrastructure to their Cloud. On the other hand, there are large software vendors (SAP, Oracle, or Salesforce), who offer their solutions as SaaS (Software as a service). Their approach is that they tell you to move your IT “As-Is” to the Cloud and clean it up later (“lift’n’shift”). However, enterprises can focus on reducing Technical Debt massively by cleaning up old pieces of software, decommissioning stuff that’s no longer needed to get a clear As-Is Situation and develop a proper roadmap to the cloud.

Migration from any IT-Systems, including software installed to the Cloud, is much more than just unplugging a server here and turning it on in another data center. It is always a so-called re-deployment, and a risk. From an IT point of view, the reduction of Technical Debt is a must-have: if you wait too long to repair your Infrastructure, the costs will be tremendous. If you do it in time, your enterprise will stay competitive.

Details full article on tomato.ch Publication

Other details in this article on outsystems.com (built in 40 second video)

5. Target2: RTGS-Zahlungen Übergang zu ISO 20022

Die Target2 Konsolidierung wird als «Big Bang» bezeichnet und erfolgt dagegen in einem vertrauten Raum mit internationalen Standards, Infrastrukturen, Schnittstellen und Prozessen.

In den letzten 15 Jahren haben auf EU-Ebene TARGET2 für RTGS-Zahlungen in EUR, das von der Europäischen Zentralbank betriebene System TARGET2 Securities (T2S) für die Wertpapierabwicklung und TARGET Instant Payment Settlement (TIPS) koexistiert, wobei alle drei nahezu autonom sind.

Aus TARGET2 wird TARGET-Services - neben der Einführung von ISO 20022 bringt die Konsolidierung weitere wesentliche Veränderungen mit sich. So verfügen alle drei TARGET-Services RTGS (real time gross settlement), T2S (Wertschriften) und TIPS (Target Instant Payment Settlement) über gemeinsame Komponenten, wie das Stammdatenverzeichnis oder das zentrale Liquiditätsmanagement.

Ab dem 20. März 2023 wird jedoch der gesamte Nachrichtenaustausch zwischen und innerhalb der drei Plattformen ausschliesslich auf der ISO-Norm 20022 basieren.

Dies erlaubt dem Finanzinstitut, alle seine servicebezogenen Aktivitäten über ein einziges Konto in Zentralbankgeld zu steuern.

Weitere Lektüre in bei PAY - Zahlungsverkehrs Magazin von der Schweizer SIX-Group (PDF 20 Seiten)

6. Deutsche Kreditwirtschaft ISO-File V2.7

Nachtrag: Ab 21. November 2022 konnten einige Tomato Corporate/Kunden ihre ISO-Zahlungsfiles nicht mehr an ihre Deutschen Sparkassen und Volksbanken übermitteln. Der Grund, das ältere DK-Format 001.003.03 Version 2.7 wurde ausser Betrieb genommen. FYI: Andere Deutsche Banken halten gewisse alte DK-Formate weiterhin am Laufen.

Nach unserer Rückfrage zu fehlenden Kundeninformationen: Die Spar und Volksbanken sind der Ansicht, dass Buchhalter und ihre ERP-Teams selber die Veränderungen erfahren sollten (Hohlschuld).

TIPP: Unsere Corporate Kunden updaten in ihrem ERP das XML-Format und wechseln für den deutschen Markt auf das neue DK-Format 001.001.03 Version 3.6.

Anmerkung: Wie viele Marktteilnehmer sind wie wir höchst unglücklich über diese Namensgebung DK-001.001.03. Der Name ist derselbe wie das internationale CGI-Format Pain 001.001.03. Die Unterschiede von DK und CGI erkennt man erst auf den zweiten Blick innerhalb des ISO 20022 File. Gut, dass in der Schweiz und Österreich die Formate am blossen Namen erkennbar sind.

bis 2025: pain.001.001.03.ch.03; neu pain.001.001.09.ch.03 und pain.001.001.03.austrian.004

Folgend das humoristische Bild vom Wege eines Zahlauftrages vom Auftraggeber bis zum Begünstigten:

Quelle Cresus - les logicies de gestion

7. ThomaBravo Owns Now Coupa/tm5

A few hours after mailing Tomato December Catch-up NL on Dec. 12th, ThomaBravo announced the acquisition of Coupa which includes the German, Swiss, Austria very widely spread TMS Bellin tm5.

The private equity firm invests primarily in technology companies and companies in the field of software development. ThomaBravo's investments comprised approximately 45 companies with combined revenues of over $17 billion in 2021. Collectively the companies employ over 60,000 people.

Some ThomaBravo Companies, Purchase year

Adenza, Finanzdiensteistungs-SW, seit 2021

Barracuda, Sicherheits-Software 2018

Exostar, Sicherheits-Software, 2020

Riverbed, Netzmanagement-SW, 2015

Qlik, Business-Intelligence-SW, 2016

McAfee, Sicherheits-Software, 2017

Kofax, Prozessmagmt-SW, 2017

Proofpoint, Sicherheits-Software, 2021

Solarwinds, IT-Infrastruktur-SW, 2016

Companies under the hood of ThomaBravo

8. Book Tip – Managing the Unmanageable: Rules, Tools, and Insights for Managing Software People and Teams

Mickey Mantle and Ron Lichty demonstrate how to recruit and train programmers, successfully onboard new hires, and create and nurture incredibly successful teams. Here now ready in the updated second edition.

Based on their over 80 years of combined experience, the authors present Rules of Thumb, Nuggets of Wisdom, checklists, and other tools for successfully leading programmers and teams, whether they are co-located or spread globally. This edition includes new information and insights into how to:

- Identify, attract, and hire the right programmers, when you need them;

- Manage programmers as the people they are;

- Inspire software professionals and teams to achieve outstanding accomplishments;

- Master the art of managing up and down;

- Accept your job as a manager who enables self-directed agile teams to succeed;

- Create a successful development subculture that can flourish even in a poisonous company culture.

9. Termine & Events

- Jan. 18 - 19, 2023: ISERD - 1433rd International Conference on Accounting and Finance (ICAF), London, UK

- Jan. 19, 2023: Aktuelle Herausforderungen im Asset Management, online event by Verband Deutscher Treasurer

- Jan. 24 - 25, 2023: 2023 Europe Bank to Bank Forum by Bankers Association for Finance and Trade, London, UK

- Jan. 31, 2023: AML & Fincrime Tech Forum 2023, London, UK

- Feb. 9, 2023: Frankfurt Digital Finance, Frankfurt, Germany

- Feb. 23, 2023: ACT Middle East Technology and Innovation Forum 2023 by the Association of Corporate Treasurers, Dubai, United Arab Emirates

- Feb. 23 - 24, 2023: Open Banking Forum on Stron Customer authentication, Frankfurt Germany

- Mar. 21, 2023: Stammtisch Young Professionals im Treasury, online event by Verband Deutscher Treasurer

- May 10 - 12, 2023: Mannheim SLG-Finanzsymposium - Kongress für Treasury- und Finanz-Management

- May 16 - 17, 2023: ACT Annual Conference by the Association of Corporate Treasurers, Newport, United Kingdon

- May 25 - 26, 2023: Enterprise Risk Management & Resilience, Security, Insurance & Captives, Zurich, Switzerland

- Jun. 19-21, 2023: Coupa Inspire EMEA 2023 in London

- Sep. 13, 2023: Swiss Treasury Summit Jahrestreffen Schweizer Treasurer, Rotkreuz (Zug/Luzern)

- Sep. 27-29, 2023: EuroFinance International Treasury Management, the world’s largest treasury event. Barcelona, Spain

10. From the Desk of Tomato

Die Wirtschaftswissenschaften faszinieren mich schon seit meiner Teenagerzeit. Ich finde Makro- und Mikroökonomie so interessant, dass ich mich stets bemühe, meine Begeisterung auf interessante Weise weiterzugeben.

Hanna Cash erklärt Wirtschaftsthemen mit humorvollen Bildern und Worten in weniger als fünf Minuten. Videos mit Themen zu Wirtschaftskreislauf, Staat, Banken und wie funktioniert Angebot und Nachfrage. Hanna zeigt auch den Import und Export, simuliert mit einer Maschine die Konjunktur und zeigt, Nachhaltigkeit ist dreifach.

Kreiert durch: Economiesuisse, Young Enterprise Switzerland (Yes) und das Institut für Wirtschaftspädagogik der Universität St. Gallen. Hanna Cash ist eine Kunstfigur und wird von der Schauspielerin Isabela de Moraes Evangelista gespielt.

Enjoy

Do you prefer English?

Economics has fascinated me since my teenage years. I find macro- and micro-economics is so interesting that I always strive to pass on my enthusiasm in interesting ways.

Hanna Cash explains economics topics in inspiring ways in less than five minutes. Videos on economic cycle, government, banks and how does supply and demand work. Hanna also shows import and export, simulates the economy with a machine and shows sustainability is not simple but triple.

Created by: Economiesuisse, Young Enterprise Switzerland (Yes) and the Institute for Business Education at the University of St. Gallen. Hanna Cash is an artificial character and is played by actress Isabela de Moraes Evangelista.

Enjoy

Check your preferred economic theme on Hanna Cash YouTube channel Deutsch / Français

Details in Werbewoche in Deutsch, Français, English, Italiano