TOMATO CATCH-UP - Newsletter Issue 245 – March 2022

Your monthly resource on working capital, process optimization, and issues related to the world of corporate treasurers, IT professionals, and bankers!

This newsletter is bilingual, English or German, depending on the source.

Introduction

Back to normality or a new normality? After almost two years of combining home and office, working from home is in most cases no longer a mandate. Instead a variety of arrangements that combine the two work spaces and often mandate spending a specific number of days a month in the office. Fortunately, we've had the opportunity to experiment with the home office long enough to decide which arrangement works best for us. We've been able to test the benefits and limitations of the technology and also better understand ourselves as social beings. Regardless of whether we create our own "normalcy" or have to adapt once again, our resilience to the unexpected will eventually prevail. This month’s Catch-Up includes topics such as Webshops, Online Coaching for Treasury Projects, 8 Digit BINs, Accounting and Ukraine War, FX Markets, Cybercrime, Open Banking, Remote Work and more.

Remember that for any challenge related to your financial issues, you can ask Martin Schneider for a discussion that will clarify it. Contact Martin via email or call +41 44 814 2001.

- Webshop: Processes and Integrations from Tomato

- Online Coaching for your Treasury Processes by Tomato

- Knowledge: 8-Digit BINs Are Coming in April

- Accounting Implications of the Ukraine War

- Prozess-Optimiert: Das Treasury generiert viel Mehrwert

- Volatile FX Markets Aren’t Going Away

- Cyberkriminelle in Microsoft Teams

- Treasury & Cash Management Providers 2022: Global, Country & Territory Winners

- Book Tip: Remote Work Revolution: Succeeding from Anywhere

- Termine & Events

- From the Desk of Tomato

1. Webshop: Processes and Integrations from Tomato

Eigentlich bin ich privat kein Fan von der Firma Amazon. Doch wenn Amazon etwas richtig gemacht hat, dann ist es der Webshop. Mit wenigen Mausklicks kann ich praktisch mein Leben aus dem Onlineshop versorgen. Mit Enthusiasmus besuche ich auch europäische Webshops. In mehr als 50% der Bestellungen ergeben sich Emails, Telefonate und Abklärungen. Das ist völlig unnötig, wären die besagten als Webshop Straight Through Processing aufgebaut.

Zurückkommend auf unseren Tomato Newsletter vom Februar zu Airport Casino Basel. Tomato AG mit seinem kleinen Team ist seit Gründung im wiederkehrenden Massenzahlungsverkehr erfolgreich tätig. Dazu gehören auch Webshops.

Seit über 20 Jahren implementieren wir mit unseren Kunden und deren Marketing/Sales/Finance Abteilung wirklich fehlerfrei funktionierende Onlineshops. Tomato’s Erfahrung basiert auf bereits im Jahre 2000 mit allen Schweizerischen Telekoms implementierte Online-Verkaufslösungen.

Zählen Sie auf uns, wir erreichen für Sie:

- Auswahl der Zahlungsmethoden (z.B. Kreditkarten, Voucher, Geschenkkarten Rechnungen);

- Vision Europaweiter grenzüberschreitender Einsatz des Akquirers;

- Auswahl des Akquirers;

- Preisverhandlungen;

- Implementation mit vollautomatischen Schnittstellen zu allen betroffenen Systemen:

Kundensystem, Warenlager, Mastercard, Visa deren Ebics Schnittstellen, Bankkonten, automatische Auszifferung aller Kostenstellen und Kundentranskaktionen, Tagesendtotalbuchung vom Debitorensystem ins ERP.

Sehen Sie unsere aussagekräftigen Zeichnungen im PDF.

Wir beantworten Ihre Fragen - machen Sie einen kostenlosen Termin mit Martin Schneider via E-Mail oder rufen Sie an auf +41 44 814 2001.

Do you prefer English?

I'm not a fan of Amazon, but the web shop is perhaps one of their most useful innovations so far. With a few clicks, I can skip real life shopping entirely. Enthusiastic, I am always tempted to use European web shops as well. In about half of the orders this results in emails, phone calls, and clarifications. This would be completely unnecessary if the web shops in question had been set up for straight-through processing.

Coming back to February Tomato Catchup News from regarding the Airport Casino Basel Tomato AG, with its small team, has been successfully helping clients implement recurring bulk payments since the very beginning. This also includes web shops. For over 20 years, we’ve been implementing with our customers and their marketing/sales/finance department flawless working online stores. We clarify for you:

- Selection of payment methods (e.g. credit cards);

- Vision Europe-wide cross-border use of the acquirer;

- Selection of the acquirer;

- Price negotiations;

- Implementation with fully automated interfaces to all systems involved, customer system, warehouse, Mastercard, Visa, their Ebics interfaces, bank accounts, automatic reconciliation of all cost centers and customer transactions, end-of-day total posting from debtor system to ERP.

See our informative illustrations in PDF in German/English

We’ll be happy to answer all your questions on this topic; make a free appointment with Martin Schneider via email or call +41 44 814 2001.

2. Online Coaching for your Treasury Processes by Tomato

Since the outbreak of Corona, videoconference tools and technology have evolved tremendously with Teams and Zoom meetings facilitating collaboration. For the past two years, we’ve been gaining a lot of experience while working remotely with our clients.

Many treasurers shared that Treasury and Company Liquidity is one issue and processes are another.

As a Treasurer, you want to understand and analyze processes yourself, to plan and implement them? Why not acquire initial data quality knowledge and hands-on experience from a professional such as Tomato, with more than 30 years of experience and 300 personally managed and implemented solutions?

We are confident that we have the appropriate tools and expertise to provide you with hourly online coaching for all your treasury payments, treasury manuals and policy challenges. Teams of 5 to 10 people from the same company or from different companies are welcome to book an appointment for coaching sessions. Are you interested? Please call Martin Schneider on +41 44 814 2001 for more details or via email.

More at https://www.tomato.ch/online-coaching.html

3. Knowledge: 8-Digit BINs Are Coming in April

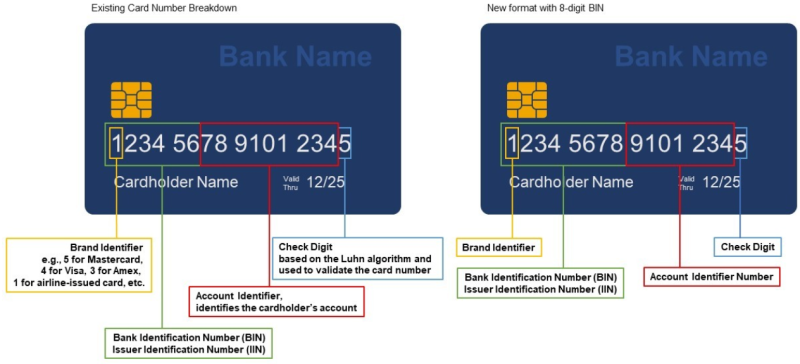

On payment cards or credit cards the BIN (or IIN, Issuer Identification Number) is the code in the PAN (personal account number) that identifies the card issuing bank, the brand of the card (Mastercard starts with 5, Visa with a 4, AMEX with a 3), the type of product the card is, and the geographical location of the card issuer.

The reason for the change is related to the fact that the industry has run out of BIN ranges up to 6 digits, so more ranges need to be made available to card issuers.

It is not mandatory for card issuers to start issuing cards with an 8-digit BIN from April 2022. Many card issuers still have a 6-digit BIN range available to them for use. In some cases, it will be five, six years or more before a card issuer will need to start issuing cards with an 8-digit BIN. However, all new products being issued from April 2022 will include the 8-digit BIN and International Card Schemes will only be issuing 8-digit BIN ranges from April 2022. 6-digit and 8-digit BINs will continue to be supported, at the same time.

Read details at a Linkedin report from Úna Dillon

4. Accounting Implications of the Ukraine War

This KPMG article of Silvan Loser and Frank Richter tackles the IFRS implications of the war in Ukraine. One of the key accounting questions under IFRS, Swiss GAAP FER (FER) and Swiss CO (CO) is: Are the implications of the war and the related events adjusting or non-adjusting events?

IFRS, FER, CO: For the reporting date 31 December 2021, the financial statement impacts of the events and market conditions arising from the war will be non-adjusting events because the changes in economic conditions and the political/business environment occurred after the reporting date. Although certain events did occur prior to 31 December 2021 (certain sanctions had previously been imposed), the invasion of Ukraine was a specific, defined event which occurred on 24 February 2022 and the significant sanctions imposed by the international community were a direct response to that invasion.

Do you need assistance in Ukraine? Martin Schneider and Tomato team taught banking and liquidity management in Kiew 1998 until 2001 and lead 10 years later a SAP integration project with a Swiss corporate client. From that time, we’ve been in contact with Ukrainian people and businesses. One local CFO and business controller fled on the first day of war to her Swiss friends. She is open to assist, monitor, and protect your assets with regard to your Ukraine business. She is hands-on, has long-time business experience with budgeting, booking, planning, IFRS, Swiss-GAP-Fer etc. She is open for a full time engagement also in Western Europe.

Please call us and we’ll make the best out of the situation. Martin Schneider via email or call +41 44 814 2001

5. Prozess-Optimiert: Das Treasury generiert viel Mehrwert

Der Bericht aus «DerTreasurer» berichtet detailliert über das neue Treasury bei Huf.

Martin Schneider: Für mich bestätigt sich wieder, wie durchgehende Prozesse bestehende enorme Kosten einsparen und Mitarbeiter arbeitszeitmässig entlastet werden. Das Projekt wurde vor der Coronakrise angedacht und bewilligt, dies um das Unternehmen Huf effizienter aufzustellen. Hinter dem Projekt stand und steht Peter Helming und sein Team.

Der Projektscope beinhaltete:

- Prozesse bereinigen

- Sonderlocken abzuschneiden

- Diszipliniert regelbasiert zu arbeiten

Mit dem Resultat:

- massive Kosten sparen

- hohe Transparenz, Tages-Visibilität in Treasury und Finanzen inklusive Zahlungsverkehr

- mit Bankguthaben teilweise die kurzfristige Inanspruchnahmen von Kontokorrentkrediten reduzieren

- Wir sehen jetzt in Echtzeit, was mit den Zahlungsströmen im Unternehmen passiert. In Krisenzeiten ist das ein immenser Vorteil.

Wie sah das Huf-Treasury vorher aus?

- 13-Wochen-Liquiditätsplanung basierend auf Excel

- Dezentrales Cash Management

- Treasury war tendenziell als Reporting-Dienstleister.

Eine neue OneScreen Treasury Management Software war die Lösung. Die Handlungs-Leitplanken wurden mit neuen Treasury Manuale bzw. Treasury Policies für Treasury und Local Controllers gebildet.

6. Volatile FX Markets Aren’t Going Away

The Global Treasurer discussed with senior strategist at Kyriba, Wolfgang Koester, the key findings from the Currency Impact Report and how corporates can manage USD 12bn in currency impacts to earnings from FX volatility.

The survey, released in February, found that many treasurers are not using the available tools and strategies despite threats to financial stability, supply chain and corporate earnings. Koester believes that FX volatility will most likely increase as other influences enter the markets, requiring treasurers to evaluate hedging strategies to effectively manage currency risk.

The key findings:

- Most treasurers use derivatives to manage currency risk;

- 75% of finance leaders state their hedging programs are effective at protecting cash and liquidity from the volatility of FX markets;

- There is vulnerability to currency movements of the US and European corporates’ revenues and earnings per share.

An important takeaway is that “vulnerability to currency fluctuations isn’t necessarily bad so long as corporate treasurers set expectations internally and externally about how they plan to manage that risk”, according to Koester. Moreover, treasury systems should have application programming interfaces (APIs) in place to fully integrate their treasury and risk management processes with their enterprise resource planning (ERPs), market data platforms and trading portals.

Read details in The Global Treasurer

7. Cyberkriminelle in Microsoft Teams

Die Zusammenarbeitslösung „Teams“ von Microsoft erfreut sich wachsender Beliebtheit. Doch mit ihrer Popularität wird die Software auch für Cyberkriminelle interessant.

Das Cybersecurity-Unternehmen Avanan erklärt, wie Cyberkriminelle Microsoft Teams zur Verbreitung von Schadsoftware nutzen.

Leider sind tausende solcher Angriffe seit Januar 2022 beobachtet worden. Cyber-Kriminelle hängen eine ausführbare Programmdatei an eine Chat-Nachricht an. Aktuell heisst die Datei oft "User Centric.exe" und verbirgt einen Trojaner. Sobald Chat-Teilnehmer darauf klicken, installiert sich die Malware, lädt weitere Programmteile nach und versucht, die Kontrolle über den Computer zu übernehmen.

Vor einem Angriff, müssen sich Cyberkriminelle Zugang zu einem Microsoft Teams-Konto verschaffen. Sie können eine Partnerorganisation oder eine E-Mail-Adresse kompromittieren und diese für den Zugriff auf Teams verwenden. Sie können auch Microsoft 365-Anmeldedaten aus einer früheren Phishing-Kampagne verwenden und so kostenlosen Zugang zu Teams und dem Rest der Office-Suite erhalten.

Ändern Sie in gewissen Zeitabläufen Ihr Passwort für Ihr MS-Konto.

Sobald Hacker Zugriff auf Microsoft Teams-Chats haben, ist die Suche nach bösartigen Dateien oder Links innerhalb der Software nur noch begrenzt möglich. Viele E-Mail-Sicherheitslösungen bieten keinen robusten Schutz für Teams.

Um die IT-Abteilung vor solchen Angriffen zu schützen:

- Implementieren Sie einen Schutz, der alle Dateien in einer Sandbox herunterlädt und sie auf bösartige Inhalte überprüft;

- Robuste, umfassende Sicherheitsmaßnahmen implementieren, die alle Kommunikationskanäle des Unternehmens, einschließlich der Teams schützen;

- Ermutigung der Endbenutzer, die IT-Abteilung zu kontaktieren, wenn sie eine unbekannte Datei sehen.

Details in Deutsch bei SwissCyberSecurity

Do you prefer English? Visit the Avanan site and download the brief document. Email credentials are needed.

8. Treasury & Cash Management Providers 2022: Global, Country & Territory Winners

Global Finance editors selected the winners for the Best Treasury & Cash Management Awards with input from industry analysts, corporate executives and technology experts.

The editors use entries submitted by financial services providers, as well as independent research, to evaluate a series of objective and subjective factors. This year’s ratings are based on the period from January 1, 2021, to December 31, 2021.

Cash flow forecasting is the top priority for companies for the next two years, according to the findings of the 2021 European Association of Corporate Treasurers’ survey of multinational companies. Almost half of the companies that participated in GTreasury’s 2021 Cash Forecasting and Visibility survey indicate they have difficulties generating cash flow forecasts.

9. Book Tip: Remote Work Revolution: Succeeding from Anywhere

This book, longlisted for the Financial Times & McKinsey business book of the year, provides a blueprint for how to build and maintain trust and connection in a digital environment. The author, Tsedal Neeley, a Harvard Business School professor and leading expert in virtual and global work, provides remote workers and leaders with the best practices to perform at the highest levels in their organizations.

Experiencing the benefits of remote working, many companies plan to permanently incorporate remote days or give employees the option to work from home full-time. As virtual work has its challenges, employees now need to know how to build trust, maintain connections without in-person interactions, and have a proper work/life balance. Managers want to know how to lead virtually, how to keep their teams motivated, what digital tools they’ll need, and how to keep employees productive.

Providing evidence-based answers to these pressing issues, the book is a good tool for navigating the enduring challenges teams and managers face. Filled with actionable steps and interactive tools, this book will help team members deliver results previously out of reach. Following Neeley’s advice, employees will be able to break through routine norms to successfully use remote work to benefit themselves, their groups, and ultimately their organizations.

10. Termine & Events

- March 28 – 29, 2022: MoneyLive Summit, on-site event in London dedicated to banking and payment professionals.

- March 31, 2022: Fraud in Financial Services, on-site event in London dedicated to professionals in financial fraud, cybercrime, security, AI, AML, risk and compliance.

- March 31, 2022: Interractive Cash Forecasting Discovery Session by TMI and CashAnalytics.

- Apr. 5, 2022: HSLU English Seminar for Expat CFO - Introduction to Switzerland; Dieses englisch-sprachige 2-Tagesseminar ist für CFO und Finanzverantwortliche konzipiert, die aus dem Ausland kommen. Behandelt werden schweizerischen Besonderheiten u.a. im Vergleich zu den Regeln in den Herkunftsländern

- Apr. 28, 2022: um 14.00 Uhr FIS und Deloitte Webinar TMS-Nutzen mit KMU Marley Spoon Berlin (250 Mio.Sales)

- May 16 – 18, 2022: Coupa Insp!re (Vormals Bellin 1TC Treasury Convention), The EMEA Community Conference Uniting with topics: Procurement, Finance, Supply Chain, Treasury, IT - Konferenz in Berlin

- May 18 - 20, 2022: Finanzsymposium by Schwabe, Ley & Greiner in Mannheim

- May 24, 2022: HSLU Conversational Interfaces (Chats, die mit Hilfe menschlicher und nicht-menschlicher Unterstützung auf Messaging-Plattformen über text-, voice- oder videobasierten Dialog stattfinden) von Banken- und Versicherungskunden/-innen immer mehr gefragt werden. Am interessantesten sind dabei Chats auf unternehmenseigenen Kanälen.

- May 31, 2022: PwC Geneva and Zurich on Jun. 13, 2022; Treasury Conference 2022 - Treasury's North Star in uncertain times

- Jun.13 – Sep. 2, 2022: Commercial Lending – Facilitated Training by American Bankers Association.

- Aug. 19, 2022: HSLU Weiterbildung CAS Corporate Finance: Unternehmerische Finanztransaktionenwie Mergers & Acquisitions (M&A), Private Equity als Finanzierungsquelle, Real Estate Management sowie Restructuring- und Turnaroundsituationen.

- Sept. 15, 2022: von 09.30-18.00 Uhr Der Swiss Treasury Summit ist das Schweizer Jahrestreffen der Treasurer in Rotkreuz bei Luzern

- Oct. 12 – 14, 2022: Alpbacher Finanzsymposium, Tirol

- Nov. 23 – 24, 2022: Structured Finance in Stuttgart

11. From the Desk of Tomato

I am glad that the winter of 2021/2022 is over, and spring is just around the corner. Then again, the snowboard season was short for me, very short, only three visits to the mountains. One reason is that we had to take into account the COVID-19 restrictions until the end of February. Another reason was that I forgot and was overwhelmed with the necessary family involvement for my son's LAP for his carpentry apprenticeship exam in April/May 2022 (preparation, guidelines, documentation, exams). My older son completed this apprenticeship 11 years ago and mine was 40 years ago. We easily forget when the stress of hard work is over after completing an important task in our lives.

The work of us accountants and pencil pushers, as they used to be called, unfortunately doesn't create a visual impression in the long run. We work on a project, come up with an elegant and successful solution, and nobody remembers us afterwards.

I admire professionals such as carpenters, artists, and sculptors whose work reveals to us the lasting beauty of their creations as you can see here the new built in wardrobe. The wood is from a cherry tree from the clients garden.

ENJOY Martin and the Tomato Team