TOMATO CATCH-UP - Newsletter Issue 229 - August 2020

Your monthly resource on working capital, process optimization and issues relating to the world of corporate treasurers, IT professionals and bankers!

This newsletter is bilingual, English or German, depending to the source.

Introduction

Welcome back from your holidays. This year was certainly different for all of us. We had to adapt, shift, re-book or maybe even cancel our preferred time with family and friends.

Maybe you have already noticed a different style in our newsletter or perhaps a different approach to certain articles. That’s because some of the English articles are suggested and /or prepared by a new member of the Tomato team, Ana Păstrăvanu. She works from Iași, Romania, the city known to be the second-fastest-growing tech hub in Europe. She has over 3 years of experience in producing content for the companies involved in the financial space and will continue Regula’s legacy and grow together with the team.

This month’s Catch-Up includes such topics as: QR invoice scanning, Risk Mgmt, Working on Cloud, Transfer Pricing.

Remember that for any challenge related to your financial issues, you can ask Martin Schneider for a discussion that will clarify it. Contact Martin via email or call +41 44 814 2001.

- Finanzplatz Schweiz: QR Invoice Scanning with Bellin TM5 for Swiss Companies

- Tools to Identify and Mitigate Risks

- Cloud Native mit IT-Potential

- Knowledge Toolkit: Why ESTR is going in effect?

- Perfectionism Makes People Difficult Colleagues

- IT and Cyber Risks for Banks Since the Outbreak of COVID-19

- OECD’s Guidelines on Transfer Pricing and Cash Pools

- Book Tip: Crucial Conversations: Tools For Talking When Stakes Are High

- Termine & Events

- From the Desk of Tomato

1. Finanzplatz Schweiz: QR Invoice Scanning with Bellin TM5 for Swiss Companies

Finanzmitarbeiter in Schweizer Firmen scannen seit dem 1. Juli erhaltene Rechnungen mit einem QR-Code in ihr ERP System. Bisher wurden die sogenannten Orangen Zahlscheine für die Kreditoren-Lieferanten-Zahlläufe eingescannt.

Für dringliche Zahlungen gibt es neu auch für das Bellin tm5 dieses Scanning und die Zahlung kann im tm5 wie andere manuelle Zahlungen freigeben werden.

Die Firma Bellin hat in Deutsch und Englisch je ein 1:15 Minuten kurzes Video parat gestellt.

English: Accounting staff within Swiss companies have been scanning invoices (since Start 1. July 2020) into their ERP system if the invoice was issued with a QR-code. For many years, the “orange” payment slips were also scanned into the Supply Chain for the ERP. For manual or urgent payments, you can now also scan these into the Bellin tm5 and then release the payment in tm5 like other manual payments.

Bellin has prepared a 1:15 minute short video in German and English for this purpose.

EN: https://www.bellin.com/blog/scan-and-pay-invoicing/

DE: https://www.bellin.com/de/blog/rechnungen-scannen-bezahlen/

2. Tools to Identify and Mitigate Risks

Risk management in corporate treasury is more important than ever in the Covid-19 crisis context. Even though the first wave of recovery is in sight, the development of the economy is highly uncertain. Along with the risk of a new infection wave, companies are impacted on more levels than before.

That’s why it is important to define risk areas and use scenarios to check what effects the current situation could have on the company. Depending on the intensity of the effects, the list of measures must be adjusted from scenario to scenario.

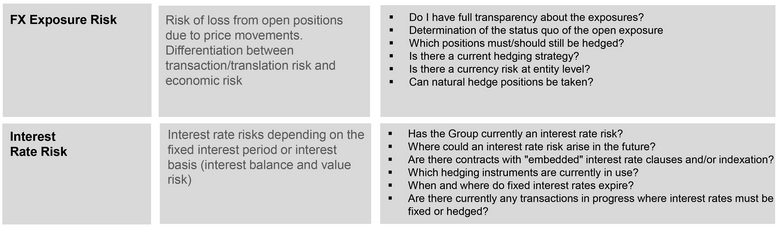

On behalf of the European Association of Corporate Treasurers (EACT), The Verband Deutscher Treasurer e.V. Risk Management-group prepared a report that specifies a risk matrix centered around potential sources of risk: Operational Risk, Liquidity Risk, Credit Risk, FX Exposure Risk, and Interest Rate Risk.

The matrix is also accompanied by a very useful checklist. Read more here on the EACT Site

3. Cloud Native mit IT-Potential

Sie fragen sich seit vielen Jahren möglicherweise: Ist die Cloud sicher? Kann mein Unternehmen mit Cloud-Services Kosten sparen? Wandern sensible Daten womöglich auf Server ausserhalb der EU?

In den meisten Unternehmen, nicht nur im deutschsprachigen Raum, geht es längst nicht mehr um das "Ob", sondern um das "Wie" eines Cloud-Einsatzes. Cloud-Native-Technologien und -Konzepte spielen dabei eine entscheidende Rolle – besagt eine neue Studie.

Ohne einen Paradigmenwechsel in der IT, der nicht nur technische Aspekte umfasst, wird der Weg für Unternehmen zur Cloud-Native-IT kaum zu schaffen sein.

Zu den grossen Hürden gehören Altsysteme, die noch immer die Kernprozesse in vielen Unternehmen steuern. Cloud Native kann nicht Legacy-Anwendungen einfach im Lift & Shift-Verfahren unverändert in die Cloud hieven. Die Alternativen vor einer Cloud-Migration sind Modernisierung oder Austausch bzw. Neuentwicklung. Die Lösung ist meist die Integration zu einer hybriden IT, also sowohl On-Premises-Systeme als auch Cloud-Native-Komponenten.

Die Studie "Cloud Native 2020" zeigt den Weg, den Reifegrad in Sachen Cloud Computing - das Sammeln von umfangreicher Projekterfahrung.

Die vollständige Studie kostet 299 EUR bei Computerwoche Online kaufen

4. Knowledge Toolkit: Why ESTR is going in effect?

The Euro Short-Term Rate (ESTR) is an interest rate benchmark that reflects the overnight borrowing costs of banks within the Eurozone. The rate is calculated and published by the ECB and is published on each TARGET2 business day based on transactions conducted and settled on the previous TARGET2 business day.

The ESTR is replacing the previous Euro Overnight Index Average (EONIA) and Euro Interbank Offered Rate (EURIBOR) to become the benchmark for the European Union (EU) and European Free Trade Association (EFTA).

The reason for this is that EURIBOR and EONIA failed to meet the requirements set out in the EU’s new benchmark regulations, which states that all interbank rates must be based on data rather than estimates and surveys.

- How it works:

The ESTR uses the transaction data from the 52 largest eurozone banks, representing the average interest rate attached to loans throughout a business day. - ESTR vs. LIBOR:

LIBOR is the average of 35 different benchmark interest rates that cover USD, EUR, GBP, JPY, and CHF, and is taken from a survey asking banks at what rate they would borrow money. The rate started to decline in use following the scandal of manipulation in 2012, increasing the necessity for a transaction-based system. - Good or bad gearing ratio?

There are basic guidelines to identify desirable and undesirable ratios: high gearing ratio (anything above 50%), low gearing ratio (anything below 25%), optimal gearing ratio (anything between 25% and 50%). - Pros and cons of ESTR:

ESTR is more transparent, based on regulated and secured data. ESTR will include a larger number of parties, leading to more accuracy in the interbank rate. Cons of ESTR: valuation risk.

EONIA rates were higher than ESTR, so some contracts might see a difference in the rates they are given.

This Bloomberg article writes on many LIBOR-Replacements around the Globe. Excellent article from the Bloomberg staff Boris Korby William Shaw Alex Harris

Ziehen Sie Deutsch vor?: IG Academy an UK A Site we find useful. Or Tomato Catch-Up News Sep-2019:

Site der ECB: warum Referenzzinsätze für die Wirtschaft wichtig sind

5. Perfectionism Makes People Difficult Colleagues

Research from various sources shows that people prefer colleagues with realistic expectations and tend to avoid perfectionists. However, perfectionism seems to be on the rise and young people are far more likely to be perfectionists than their predecessors.

Perfectionists are perceived to be those who await the impossible from themselves or others, put too much effort into making minor or even invisible adjustments, and end up exhausted.

Research suggests that perfectionism isn’t a quality you should brag about, it can actually negatively affect the workplace environment, teamwork, and eventually yourself.

A meta-analysis conducted at the Georgia Institute of Technology explored two types of perfectionists: the “excellence-seeking” and “failure-avoiding” types of perfectionists. The first type fixates on achieving excessively high standards, while the second is obsessed with not making mistakes. The “failure avoiding” type seems to be less “agreeable”.

There is no indication that perfectionism could lead to higher job performance. Moreover, perfectionist colleagues may wind up failing, especially when it comes to getting along with others.

Ziehen Sie Deutsch vor: Hier eine ähnliche Ansicht bei Jobs.de

Perfektionismus im Job: Wenn gut nie gut genug ist.

6. IT and Cyber Risks for Banks Since the Outbreak of COVID-19

Pierre Guerineau, manager at KPMG ECB Office, takes a look at ICT and cyber risk in the context of COVID-19 and at the way banks should react.

This year, supervisors stepped up their monitoring of banks’ operations and asked institutions to review their business continuity plans, with a focus on banks’ operational resilience and ICT infrastructure.

Mr Guerineau explains

- What good banks should come out post-pandemic with

- What actions some banks in difficulty should consider

- What actions supervisors will likely focus on as the pandemic develops.

Details at KPMG and European Bank Authority EBA press release

7. OECD’s Guidelines on Transfer Pricing and Cash Pools

PwC Switzerland’s David McDonald and Michalis Louca discussed on July 7th how intercompany financing transactions should be priced in the light of OECD’s new guidelines for financial transactions.

Key changes and principles

- A new description of a transaction: an assessment of options realistically available to borrower and lender including an assessment of market/economic conditions.

- The volume of loan must not exceed the amount that the borrower could/would have borrowed.

- Only a small return can be justified to a lender/guarantor/treasury center.

Challenges and actions

- Groups will need a process for new transactions (assessing the key terms, the quantum of the loan, the lender, and the borrower perspective) and to perform a one-off review of existing transactions for compliance with the new requirements.

Treasury functions – intra-group loans and cash pooling (CP)

- Pricing loans between group companies will require credit rating analyses.

- Interest rates should be benchmarked; bank quotes should not be used as benchmarks.

- Most cash pools will need to amend the rationale for economic returns.

- The rates that participants get from the pool versus local market rates should be tested.

- Cash pool positions should be only short term.

Financial guarantees:

- No guarantee fees payable unless there is an explicit guarantee.

- Perform benefit assessment.

- MNEs need to assess when a guarantee fee is/is not charged accordingly.

- Groups may choose to change the agreements covering the guarantee, rather than changing the pricing.

PwC Slides of this Webinar July 7th 2020

Ziehen Sie Deutsch vor? Unter Punkt 9 Termine & Events lesen Sie zur HSLU Weiterbildung Transfer Pricing

8. Book Tip: Crucial Conversations: Tools for Talking When Stakes Are High

The book draws our attention to those defining moments that literally shape our lives, our relationships, and our world. It offers techniques for holding crucial conversations in a positive space when emotions are highly charged. The findings are based on 25 years of research with 20,000 people.

Our success in life is dictated by the quality of our relationships. Some people seem better at holding deeper, more honest conversations that create a new level of bonding and are able to transform people, situations, and relationships.

7 steps should be taken into account:

- First manage your emotions and mindset.

- Get all the relevant information out in the open in a 2-way flow of information

- Be flexible, addressing the issues as they emerge through the dynamic exchange

- Control your emotions by naming them (anger, frustration etc)

- Agree on a mutual objective

- Separate facts from the story

- Agree on a clear action plan

Investieren Sie in Ihre Weiterbildung:

Zug: Swiss Corporate Treasurer bei der HSLU:

Die nächste Ausbildung für den Swiss Certified Treasurer beginnt am 28. August 2020

Dauer 12 Monate, jeweils Donnerstag, Freitag und Samstagmorgen

Frankfurt: VDT Basisqualifizierung Treasury

Der Kurs mit 3 Modulen beginnt am 3. und 4. September 2020

https://vdtev.de/basisqualifizierung Dieser Kurs ist Onsite und Online.

Zug: Wie vieles wurde der Swiss Treasury Summit im September 2020 auf 2021 verschoben.

Swiss Treasury Summit 2021 Donnerstag 09.09.2021

Als Ersatz für dieses Jahr: sechs Online-Workshops im Herbst 2020

Sechsmal einstündige Vorträge. Details und Anmeldung.

Zug: Info-Veranstaltung aller Weiterbildungen

Mittwoch 4. November 2020 HSLU Zug 18:15 bis 20:30 Uhr

Zug: 21. und 28.10.2020, 4.11.2020 Aktuelle Herausforderungen zu Transfer Pricing

Veranstaltung und Anmeldung Der Kurs ist auch tageweise besuchbar.

Alpbach im Tirol: das 34. Alpbacher Finanzsymposium 07. Bis 09. Oktober 2020

Frankfurt: Certified Corporate Treasurer VDT.

Der Kurs mit 5 Modulen beginnt am 5. November 2020

https://vdtev.de/certified-corporate-treasurer-vdt

Zeitspanne von November bis April, jeweils Donnerstag, Freitag und Samstagmorgen

Structured Finance: im Corona Jahr digital 23. bis 26. November 2020

Ferien in der Corona Zeit. - Nach dem verordneten Bewegungsstillstand machte ich mir erstmal gar keine Urlaubspläne mehr. Vielmehr galt es Schäden zu begrenzen, Kunden unterstützen in schwierigen Situationen, Mitarbeiter zu führen, Liquidität sichern, Resilienz also die Widerstandskraft zu erhöhen, eine mögliche Betriebsschliessung auf die längst mögliche Zeit zu sichern. Immer mit dem Ziel für Sie und mich die Tomato Fahne weiterhin wehen zu lassen, Kunden Lösungen aufzeigen und erwirtschaften.

Aus diesem Szenario ergaben sich keine Ferienpläne. Vereinzelt hörte ich von Touren über Griechenland nach Nord-Mazedonien, Richtung Norden. Doch dann ergab sich eines nach dem anderen:

Ich recherchierte für mögliche spätere Tomato-Kunden Deutsch-Sprechende-Callcenter- und Video-Überwachungsdienste im technisch gut ausgebildeten und arbeitsgünstigen Kosovo/Albanien. Aus dem unsäglichen Kosovo Krieg vor rund 20 Jahren streben gut ausgebildete technisch versierte Menschen aus der DACH Region wieder nach Hause in den Kosovo. Mit der unter Schweizer Leitung stehenden Firma www.baruti.ch wurde ich fündig. Nicht nur dies, auch die angedachte Reise wurde über meine gewachsenen Kosovo Beziehungen entscheidungsfreudig schnell Realität.

Saimir Shala, vormals Sulzer SAP-Finance-HR-Projektleiter in vielen Ländern für Training und Rollout unterwegs. Vor drei Jahren setzten er und Partnerin Aylin Bakir früher EY-Tax-Consultant ihren Traum mit albanienreisen.ch um. Eine Chance für uns Mitteleuropäer die Kultur, Leute und Berge von rund um Albanien kennen zu lernen.

Unsere Reisegruppe war klein, für eine Woche wanderten wir in Nordalbanien fünf Berge um 2.500 Meter über Meer meist im Grenzland Albanien, Montenegro, Kosovo. Im Bild Kosovo höchster Berg der Gjeravica 2.656 MüM. Unser aller Glück war, dass Albanien diesen Sommer nicht unter den Covid Risikoländern aufgeführt wurde.

For this year, I decided just a one-week hiking vacation, climbing five mountains of 2.500m height in the North-East of the Albanian Mountains, Montenegro and Kosovo. Hiking paths are white/red-marked as everywhere in Central Europe. However, not being able to communicate with local people in Albanian, the entire journey wouldn’t have been possible without Saimir as a guide. Saimir Shala is a Swiss Kosovo native, and an excellent and experienced guide, who accompanied us into the country and introduced us the history and the local people.