TOMATO CATCH-UP - Newsletter Issue 227 – May 2020

Your monthly resource on working capital, process optimization and issues relating to the world of corporate treasurers, IT professionals and bankers!

This newsletter is bilingual, English or German depending to the source.

Introduction:

Are you weary of working from home? Some people we talked to can’t wait to return to the office. Others enjoyed the greater flexibility from employers who previously didn't offer the possibility to let their people occasionally work from home. For them it proved that such a system can work; and that it is a huge advantage especially for those who have a long commute.

We at Tomato were lucky to be able to work at the office without interruption, mainly because last summer we rented additional space, which allowed us to expand the office considerably. It even offered us space to set up a foosball (yes it’s called a foosball table, check google) table which is perfect for recharging our batteries.

This month’s Catch-Up includes e-banking, new regulations, supply chains, digital finance, crypto currency, and more.

Remember that for any challenge related to your financial issues, you can ask Martin Schneider for a discussion that will clarify it. Contact Martin via email or call +41 44 814 2001.

- Automated Finance Status is Key to resilience

- PwC’s COVID-19 CFO Pulse Survey

- Lieferketten und Corporate Social Responsibility

- SAP Bellin API Link / Schnittstelle

- Pros and Cons of Video Conferencing

- Schweizer ZV: Update Merkblatt QR-Rechung nach Swift MT101

- How to Turn Cryptocurrency Payments into a Fast and Secure Process

- Covid-19’s Impact on Digital Finance in 2020 and Beyond

- Book Tip: The 7 Habits of Highly Effective People: 30th Anniversary Edition

- Termine & Events

- From the Desk of Tomato

1. Automated Finance Status is Key to resilience

The numerous responses to last month’s piece in our newsletter Resilience: The Key in Crisis Situations illustrates how important a daily worldwide finance status currency separated is.

To remind you, we wrote:

“Many local controllers still manually check e-banking and report the data - also manually - to headquarters. There is no better time to implement these processes and structures than now.

In recent years, arguments against the implementation of e-banking solutions included: too costly, too time-consuming, or too reluctant to implement them?

Now many wish they had already implemented it. The local people and their time cost much more than the average monthly rate of 30 EUR per account and month.”

https://www.tomato.ch/newsletter-2020-04.html#l9

Source of Picture from tomato.ch Fachbeiträge De-zentrale Payment Factory

2. PwC’s COVID-19 CFO Pulse Survey

PwC is following the attitudes and priorities around the COVID 19 outbreak among financial sector leaders. In the week of May 4, they surveyed 867 CFOs from 24 countries or territories. The survey is the fourth they have conducted around the world lately with the aim to provide a thorough overview of the impact the crisis is having on people and businesses around the world.

Top findings on 11 May 2020:

- 70% of CFOs believe they can provide a safe environment for returning employees;

- 75% of companies will change workplace safety measures; nearly half plan to accelerate automation;

- 43% CFOs will focus in the near future on employee protections such as sick leave and other benefits;

- 51% CFOs plan to develop additional sourcing options for their supply chains;

- Many CFOs will cut or defer capex investments, but significantly fewer plan to cancel digital spending.

Insights from global finance leaders on the crisis and response – 11 May 2020

Im Artikel Schweizer Finanzchefs sorgen sich um Lieferketten berichtet die FuW (Finanz und Wirtschaft) über die Resultate der PwC Umfrage.

Schweizer Unternehmen sind abhängiger von externen Partnern, so konzentrieren sich die Finanzchefs auf die Stärkung der Versorgungsgebiete, insbesondere in der Zeit der Corona-Krise. Zudem vertrauen sie ihren Mitarbeitern im Home Office mehr als die Kollegen in anderen Ländern, sagt Reto Brunner von PwC Schweiz

Details in der Schweizerischen Finanz und Wirtschaft CFO-Befragung...

3. Lieferketten und Corporate Social Responsibility

Viele Unternehmen erkennen ihre gesellschaftliche Verantwortung seit langem an, ohne sich als CSR zu bezeichnen. Unternehmen kennen die positive Ausstrahlung des eigenen Unternehmensimages

Das Bundesministerium für Arbeit und Soziales erklärt was CSR ist, wie es mit globalen Herausforderungen zusammenhängt und welchen Nutzen sie für Unternehmen hat. Details…

Corporate Social Responsibility zu praktizieren ist besonders wichtig im globalen Bereich wo soziale Verhältnisse und Gewohnheiten mit Partnern unterschiedlich sind. Das gilt also auch für Supply Chain Management.

Im Artikel “Impulse für ein verantwortungsvolles Lieferkettenmanagement aus der Unternehmenspraxis” des Bundesministeriums wird erläutert, wie Lieferketten nachhaltig und transparent gestaltet werden können. Eine ausgezeichnete Ressource!

In unseren Recherchen sind wir auch auf SupplyOn gestossen, einem Provider bei München, der die elektronische Verwaltung von Prozessen mit so vielen Kunden wie möglich über eine einzige Plattform anbietet.

COVID-19 richtig einschätzen - was ist zum Zeitpunkt der Disruption zu tun um das Unternehmen am Laufen zu halten. So ist z.B zum Etablieren präventiver Massnahmen eine enge Zusammenarbeit mit Lieferanten entscheidend, damit auf spezifische Situationen reagiert oder Probleme systematisch gelöst werden können

Die wichtigsten Schritte:

Risiko bewerten

- Jeder Ort auf der Welt kann betroffen sein. Deshalb ist es wichtig, alle Ihre Lieferanten zu überwachen, auch in Gebieten mit geringem Risiko.

- Fordern Sie von Ihren Lieferanten eine kurze Einschätzung ihrer aktuellen und zu erwartenden Situation.

- Bleiben Sie in engem Kontakt mit Ihren gefährdeten Lieferanten, um deren Hauptrisiken zu überwachen. Nutzen Sie einen zentralen Kommunikationskanal, um den Überblick zu behalten.

- Fordern Sie Produktions- und Notfallpläne an (z.B. via Flexible Surveys).

Geschäftsbetrieb sicherstellen:

- Stellen Sie sicher, dass Ihre Lieferanten über ein solides Business Continuity Management (BCM) verfügen.

- Sorgen Sie dafür, dass Ihnen die Kontaktdaten aller wichtigen Ansprechpartner zur Verfügung stehen, einschließlich der jeweiligen Vertreter.

- Führen Sie mit Ihren Lieferanten Massnahmen zur Risikominimierung durch.

Details unter supplyOn München…

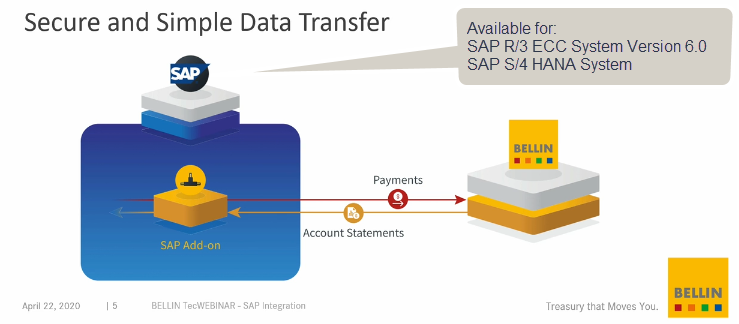

4. SAP Bellin API Link / Schnittstelle

English: Many of Tomato’s clients use the BELLIN tm5 TMS. The company recently released an SAP integration based on API technology.

API data transfer seamlessly connects the SAP ERP system landscape with tm5, maximizing security, transparency and process control since no files are shared. The data transfer works in both directions: collate account statements and process payments. The SAP integration enables the client’s SAP system to retrieve account statement directly and at any time. For payments, the files generated in the SAP system are transferred to tm5 where they’re processed.

In this webinar with Karsten Kiefer, BELLIN SAP Integration Product Manager, shows the new SAP integration directly in the system and highlights the various benefits (52 mins).

English https://www.bellin.com/webinars/bellin-techwebinar/

Martin comment: Until now creating and defining the upload/download of files was sometimes time-consuming. For the future I invite tm5 clients to discover the time-saving benefits of this new SAP integration.

Bevorzugen Sie Deutsch?

Viele unserer Kunden nutzen tm5, das TMS von BELLIN. Jetzt hat BELLIN eine SAP Integration für tm5 entwickelt, die Daten auf Basis der API-Technologie transferiert.

Die BELLIN SAP Integration verknüpft die SAP-ERP-Landschaft eines Unternehmens nahtlos mit dem System von BELLIN. Da kein File-Sharing erfolgt, sorgt diese Technologie für maximale Sicherheit, Transparenz und Prozesskontrolle.

Die Datenverarbeitung funktioniert in beide Richtungen: beim Verarbeiten der Kontoauszüge wie bei der Abwicklung des Zahlungsverkehrs. Durch die SAP-Integration kann das SAP-System des Kunden den Kontoauszug direkt und jederzeit abrufen. Für Zahlungen werden die im SAP-System generierten Dateien an tm5 übertragen, wo sie verarbeitet werden.

Karsten Kiefer, Product Manager der BELLIN SAP Integration, zeigt in dem BELLIN TechWEBINAR, wie die neue SAP Integration live im System funktioniert und erläutert die Vorteile (52 Min.).

Deutsch: https://www.bellin.com/de/webinare/bellin-techwebinar/

Kommentar von Martin Schneider: Bisher war das Erstellen und Definieren des streng geschützten Filefolders manchmal zeitaufwändig. Schauen Sie sich diese zeitsparende SAP-Integration an.

Screen from the Webinar at 5:25 min

5. Pros and Cons of Video Conferencing

Since COVID-19 has forced many teams to work remotely, Zachary Yorke, UX Researcher at Google, explains the science behind remote meetings and shares some interesting findings based on his experience in remote communication.

- Milliseconds matter: We are genetically programmed for a fast-paced exchange of in-person conversation and a delay of five-tenths of a second (500 ms) from laggy audio or fumbling for the unmute button is more than double what we're used to in-person.

- Virtual conversations improve group performance

- Virtual cues are very effective: In video calls, we feel more comfortable when our listeners' eyes are visible because we can read their emotions and reactions.

- Distance amplifies trust issues: In remote teams, when an issue pops up, individuals are more likely to blame one another rather than assessing the situation, which has a negative impact on group cohesion and performance.

- A “talking stick” is a good option

Deutsch: in der NZZ Wochenend-Ausgabe berichtet Prof. Dr. Carmen Zahn von der Fachhochschule Nordwestschweiz, warum Videochats anstrengend sind.

Sollten Sie den Artikel nicht lesen können (Login oder Abonnement) senden wir Ihnen gerne den Bericht.

6. Schweizer ZV: Update Merkblatt QR-Rechung nach Swift MT101

Das Merkblatt über die bankfachlichen Regeln, die die Konvertierung der Felder im Swiss QR Code in eine SWIFT-FIN-Meldung (MT101 und MT103) ermöglichen, wurde auf Seite 15 angepasst: Unter «Referenztyp», «70 Remittance Information» und «Linie 1» wurde «QRR/QR Referenz» in «/QRR/QR Referenz» bzw. «SCOR/Referenz» in «/SCOR/Referenz» korrigiert.

Zum Dokument Mapping QR-Rechnung/SWIFT FIN

Die Einführungsdrehbücher gibt es nun auch in italienischer Version neben DE FR EN.

Gli script introduttivi per la fatturazione QR per gli istituti finanziari, gli emittenti di fatture e i destinatari delle fatture sono disponibili anche in italiano.

Alle sceneggiature introduttive

Alle Drehbücher und Sprachen für QR-Rechnung ab 30.06.2020 unter PaymentStandard.ch

7. How to Turn Cryptocurrency Payments into a Fast and Secure Process

Cryptocurrencies such as Bitcoin, Ethereum or Ripple have become a popular and established investment strategy. However, transactions with cryptocurrencies are still slow and therefore not suitable for everyday purchases. To address this issue, ETH Professor Srdjan Capkun and his team have developed a system that makes cryptocurrency payments secure, fast and practical. They’ve named their solution “Snappy” because it enables payments to go like a snap of the fingers.

It all started with building of a digital deposit system that runs in the background of the payment process. In addition to the purchase amount, customers place a deposit of the same value for as long as it takes to confirm the payment. This deposit is active for only three minutes and is not visible in the user’s own virtual wallet.

Sellers also need to provide deposits when using Snappy. The deposits they pay are higher than those of the buyers and are equal to the sum of all the individual sellers’ transactions that take place in the same timeframe.

To use Snappy, you need to deploy its algorithms and protocols on the Ethereum blockchain. The system is not yet being used in practice, but Capkun believes it will become a popular feature of smartphone apps.

8. Covid-19’s Impact on Digital Finance in 2020 and Beyond

Teunis Brosens, Lead Economist for Digital Finance and Regulation, ING, and Carlo Cocuzzo, Economist, Digital Finance, ING, present their view on how Covid19 is accelerating Digital Finance. The two analysts believe that we will see shifts in the relationship between the public and private sector in finance, changes to global interconnectedness, the need cybersecurity cooperation, a higher concern for financial inclusion and shifting attitudes towards data. Other changes to expect next:

- A reassessment of the governments’ role in the financial sector;

- A de-globalization trend – COVID-19 has exposed the fragilities underpinning globalization;

- work from home will place more importance on domestic digital infrastructures;

- Focus on cybersecurity: more steps in international cooperation between businesses but also information exchange between international information agencies, cybercrime agencies – the more info is exchanged, the better everyone can prepare for threats;

- ID verification via video call to be accepted rapidly;

- The rise of digital financial intermediaries and the demise of local physical branches;

- An increased awareness of financial inclusion and financial security;

- improved access to financial products for self-employed people, temporary workers, SMEs;

- Data sharing attitudes: the European Comission had already declared data the center of its strategy for years ahead;

- The advantages of sharing data will become more apparent.

Details on Finextra Youtube Video

9. Book Tip: The 7 Habits of Highly Effective People: 30th Anniversary Edition

The 7 Habits of Highly Effective People has captivated readers for three decades. Dr. Stephen Covey's emphasis on self-renewal and his understanding that leadership and creativity require us to tap into our own physical, mental and spiritual resources is as relevant today as it was 30 years ago.

Sean Covey (Stephen Covey’s son) added insights on how to use the habits in our modern age, the wisdom of the 7 Habits is updated for a new generation of leaders. The 7 habits are:

- Be Proactive

- Begin with the End in Mind

- Put First Things First

- Think Win/Win

- Seek First to Understand, Then to Be Understood

- Synergize

- Sharpen the Saw

PwC Treasury community webcast Tuesday, June 2nd, 2020 from 14.00 to 15.00

Although this year's PwC Treasury Conferences were cancelled due to the COVID-19 crisis, they offer a free one-hour webinar to tackle these opportunities through a series of "Lightning Talks" by experts in the areas of treasury, tax, regulatory developments, cyber-security and sustainable financing.

Zur Anmeldung Treasury Community Webcast

Annual AFP 2020 Conference Las Vegas Oct. 18-21

Even though most of us will not be able to take part in the annual Association for Financial Professionals’ conference, the Event website offers a wealth of information and a feel for pertinent topics on the agenda.

Link to Brochure and General Information

- To get a feel for the experience (1 minute intro)

- Shell explains efforts to pilot and adopt market standard, cloud technology for their FP&A function.

(12 minutes) - Exploiting the Gap Between IT and Finance (15 minutes)

Review the speakers, the program and follow the site on Twitter.

Start with General Information…

HSLU Seminar in Zug 21, 28.10.2020, 4.11.2020 Aktuelle Herausforderungen im Corporate Treasury

Inhalte:

Transfer Pricing

- OECD BEPS Übersicht und Relevanz für Schweizer Unternehmen

- Steuerliche und rechtliche Aspekte von Cash Pools

- die Auswirkungen der Schweizer Steuerreform auf Unternehmen und Treasuries

- relevante Accounting-Themen aus Treasury-Perspektive

- den Regime-Wechsel von LIBOR zu SARAON/SOFR/SONIA

Veranstaltung und Anmeldung

Der Kurs ist auch tageweise besuchbar.

To be rescheduled: Tomato’s Brown Bag Lunch in 2020 in your area

Do you wish to be host and have ideas of themes to discuss in an insider Group of Treasurers in you region?

Time from is lunch time from noon to 2 pm max.

Let us know and Contact Martin via email or call 044 814 2001.

Dr. Ignaz Semelweis, a Hungarian physician and scientist, was an early pioneer of antiseptic procedures. In the 1850s, he recommended the practice of washing hands with chlorinated lime solutions, while working in Vienna’s first obstetrical clinic, where the mortality rate among doctors’ wards was three times higher than midwives’ wards. Even though the death rate of mothers and babies dropped dramatically, his ideas were initially rejected by the medical community. Well, this has been a common practice for well over a century.

Now, with COVID-19 raging and endangering our health, we’ve come to accept the practice of keeping two meters distance between one another and refraining from shaking hands, hugging, etc. Even within families, where a person works from home, we’ve come to accept the need for a separate office space. We have accepted these measures even though they can lead to depression and other psychological problems. So it took 170 years for us to be a step further in human development and recognize how contagious the flu and other related illness are.