TOMATO CATCH-UP - Newsletter Issue 255 – March 2023

Your monthly resource on working capital, process optimization, and issues related to the world of corporate treasurers, IT professionals, and bankers!

This newsletter is bilingual, English or German, depending on the source.

Introduction

Time flies and all stakeholders in the economy are revising again business objectives and strategies as the closing of first quarter of 2023 approaches. With the continued uncertainty and rapidly changing economic landscape, it’s more important than ever for businesses and professionals to stay informed and adaptable. As always, this issue of the newsletter touches upon the latest market trends, developments, and key topics that are critical to your business, offering you insights into the most effective strategies for navigating the current financial climate.

This month’s Catch-Up includes topics such as EBICS, SWIFT, ISO 31700, Cash Management, Inflation, BEPS, Taxes, AI, and more.

Remember that for any challenge related to your financial issues, you can ask Martin Schneider for a discussion that will

- What is EBICS - a Boring or Useful Reading?

- What is SWIFTnet - 99 Problems but SWIFT Connectivity Ain’t It

- Now the Question: EBICS or SWIFT?

- Top-Banken im Cash Management 2023 in Deutschland

- The New ISO 31700 Standard for Privacy by Design

- Taxes: BEPS 2.0 – Base Erosion and Profit Tax Shifting

- A Reporter Breaks Into his Bank Account With AI-Generated Voice

- Book Tip - All-in on AI: How Smart Companies Win Big with Artificial Intelligence

- Termine & Events

- From the Desk of Tomato, yes time flies…

1. What is EBICS - a Boring or Useful Reading?

We read an interesting overview of EBICS, which the author on SEPA for Corporates calls “the most boring article on EBICS” – we’ll let you decide for yourselves. Here is the brief on these topics:

- EBICS is the Electronic Banking Internet Communication Standard and is widely used in Germany;

- EBICS History:

- 2003 EBICS deployments start in Germany;

- 2008 EBICS is mandatory for banks in Germany;

- 2011 French banks are required to complete their standard to EBICS;

- 2015 Switzerland joins EBICS;

- 2020 Austria joins EBICS; - EBICS is a solution that offers a single, common, and open standard for corporates to connect with ALL of their banks in Austria, France, Germany, and Switzerland;

- How is EBICS set up? Your bank guides and supports you with your EBICS implementation;

- What File Formats does EBICS Support? SWIFT MT messages (MT101 and MT940) and ISO20022 XML.

Sometimes I am lazy when reading foreign language texts then I simply copy paste the text into deepl.com it is so perfect and easy to read.

2. What is SWIFTnet - 99 Problems but SWIFT Connectivity Ain’t It

From the same source the author describes Swift for Corporates. Here in no particular order: A single global bank connectivity solution: the overall bank architecture is simplified and standardized across the different banking partners;

- Improved controls: you can implement better controls and replace manual interfaces with an automated SWIFT solution;

- Reduced internal & external costs of maintaining and supporting multiple solutions and of various bank solutions. Cost reduction depends on the number of banks with whom you have a bank interface, number of bank interfaces, traffic volume, number of countries that you’re operating in;

- Security: SWIFT offers corporates a trusted global solution;

- Reliability: SWIFT boasts 99.99% network availability and has never ‘lost’ a FIN message;

- A global solution: corporates can take advantage of the SWIFT network and connect with their banks and bank branches around the world;

- Straight Through Processing – STP: standard global data formats for payments (MT101 and ISO20022 XML PAIN.001) and bank statements (MT940 / MT942 formats). By ensuring that your ERP systems can generate and accept these SWIFT standard formats, you can start building efficient global daily processes. This enables your payment messages to go straight through the process at the bank and reduces the time spent on manually entering bank statements and / or fixing payment errors.

Sometimes I am lazy when reading foreign language texts then I simply copy paste the text into deepl.com it is so perfect and easy to read.

3. Now the Question: EBICS or SWIFT?

In this article by Leonor Lourenço, both EBICS & SWIFT are analyzed and compared. The two options are both compatible with SEPA and ISO 20022 XML, offer digital signature, and safe and secure internet communication. However, there are differences. The following list is a mix by the author, enriched by our experienced Martin Schneider:

- EBICS focuses especially on payments and cash management;

- SWIFT also covers Hedging (FX Transactions) and Guarantees;

- EBICS is a European solution - if corporates work mostly with European banks, this is probably the most cost-efficient solution;

- SWIFT allows corporates to connect with banks around the world;

- EBICS works on Versions actually 3.0, which has to be adopted by each of the four countries (Austria, France, Germany, and Switzerland);

- SWIFT is a worldwide standard first made by the banks;

- EBICS testing is simply done through penny testing, while

- SWIFT has a test system on the banks’ side and corporate side (likewise SAP-Test, SAP-Quality, SAP- Productive);

- EBICS signs with a digital signature depending on country and bank, and is many times a signature from an individual (Treasurer, Head of Accountant, CFO), while

- SWIFT signs with a corporate seal or system signature.

Read details of the article from Leonor Lourenco

4. Top-Banken im Cash Management 2023 in Deutschland

DerTreasurer und Coalition Greenwich berichten: Deutsche Banken bleiben im Cash Management in Deutschland auch in diesem Jahr führend, ausländische Banken holen weiter Marktplätze. Die Commerzbank ist das dritte Jahr in Folge die Top-Bank im Cash Management mit Blick auf die Marktdurchdringung. Befragt wurden im europäischen Raum mehr als 900 CFOs und Treasurer aus Unternehmen ab 500 Millionen Euro Umsatz, darunter waren knapp 400 Unternehmen mit einem Umsatz von mehr als 2 Milliarden Euro. Im deutschen Raum wurden dazu knapp 100 Unternehmen befragt.

Do you prefer English?

Report from Coalition Greenwich: German banks remain leaders in Germany in cash management this year. Foreign banks continue to gain market share. Commerzbank remains the top bank in cash management in terms of market penetration - for the third year in a row.

More than 900 CFOs and treasurers from companies with sales of 500 million euros or more were surveyed in Europe, including almost 400 companies with sales of more than 2 billion euros. In Germany, just under 100 companies were surveyed.

Details at Coalition Greenwich

5. The New ISO 31700 Standard for Privacy by Design

An article by Philipp Rosenbauer PwC: Since 8. February 2023, Privacy by Design is an ISO standard titled «Consumer Protection – Privacy by Design for Consumer Goods and Services». The standard consists of both a high-level list of requirements (31700-1) and a more technical report through illustrative use cases to help understand the requirements (31700-2).

Privacy by Design calls for the integration of privacy into the architecture of goods and services and within business practice. Not only is it a requirement under EU law but also under the Swiss revised Federal Data Protection Act, Article 7.

Products and services are the front line of consumer protection, and it is important that organizations have control over their operations. However, they do not have control of the way consumers use the products and services. As such, the only protection is the functionality that is embodied within the hardware and software. The new standard follows the data protection by design and by default principle of the General Data Protection Regulation (GDPR) and brings uniformity to privacy by design, albeit not a conformance standard.

Details at PwC Insights Regulations

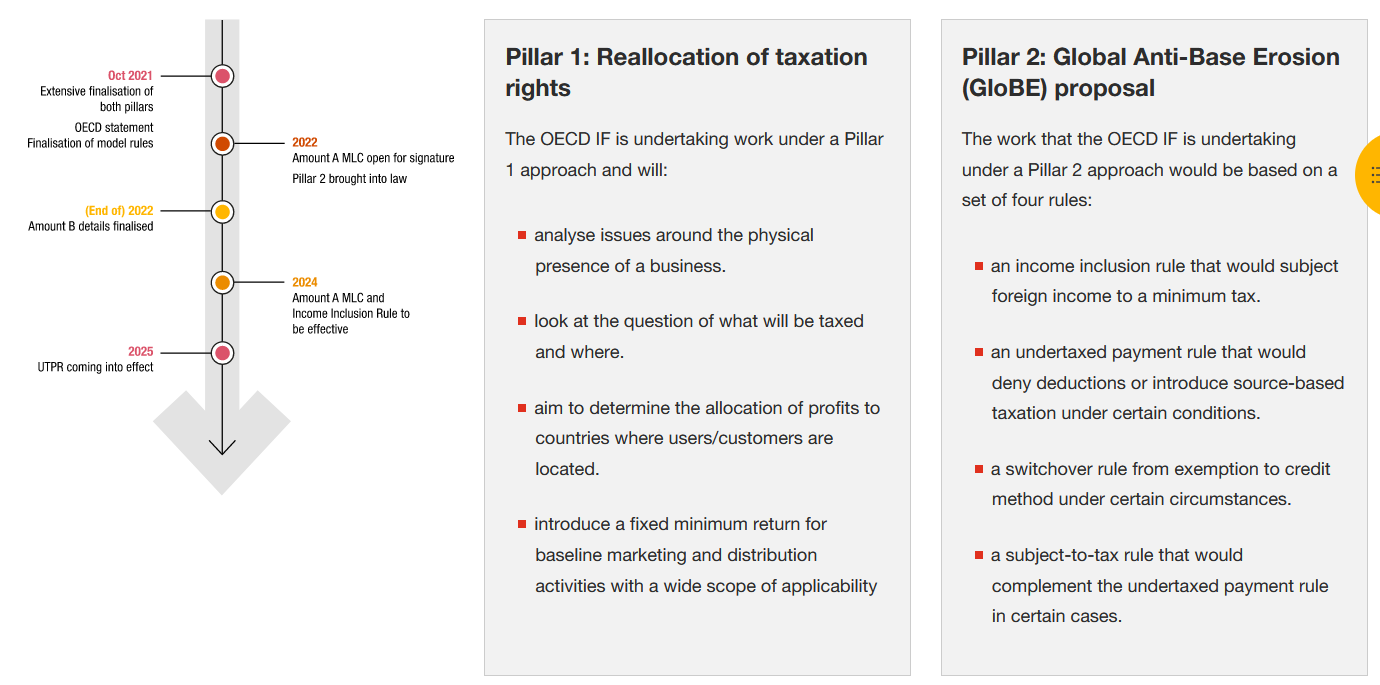

6. Taxes: BEPS 2.0 – Base Erosion and Profit Tax Shifting

Ein Bericht von PwC. Die jahrelange Diskussion um die Besteuerung grosser internationaler Konzerne wird bald Realität. Das von der OECD vorangetriebene Projekt «Base erosion and profit shifting 2.0», besser bekannt unter dem Kürzel «BEPS 2.0» – wird zu signifikanten Umwälzungen in der Steuer- und Standortpolitik führen.

Im Bericht in deutscher Version lesen Sie zu den Topics:

- Zum Hintergrund

- Säule 2 im Überblick (Unternehmen von 750 Mio. weltweiten Umsatz)

- 15% Steuern wovon?

- Konsequenzen einer Niedrigbesteuerung

- Was bedeutet dies für die Schweiz?

- Fazit

Do you prefer English?

On 2 February 2023, the OECD released the Agreed Administrative Guidance for the Pillar Two GloBE Rules as part of the Implementation Framework. The Guidance covers 26 topics regarding Scope, Income and Taxes, Insurance companies, Transition period, and Qualified Domestic Minimum Top-up Taxes. Further Guidance can be expected to be published on an ongoing basis. The Administrative Guidance will be incorporated into a revised version of the Commentary that will be released later this year.

Diese Tabelle ansehen in Deutsch

7. A Reporter Breaks Into his Bank Account With AI-Generated Voice

An article from vice: Some banks in the US and Europe tout voice ID as a secure way to log into your account. Vice Motherboard's Joseph Cox proved it's possible to trick such systems with free or cheap AI-generated voices.

Vice Motherboard's Joseph Cox could "break into" his bank account using a freely available AI voice generator that successfully imitated Cox's voice so effectively that the bank's voice-based biometric security system didn't detect anything wrong.

The reporter phoned his bank's automated service line and played a sound clip "check my balance, " a synthetic clone he had made using readily available artificial intelligence technology. The bank's security system spent a few seconds authenticating the voice. The reporter was eventually granted access to the account information, including balances and a list of recent transactions and transfers.

Some banks tout voice identification as equivalent to a fingerprint, but this experiment shatters the idea that voice-based biometric security provides foolproof protection.

The Consumer Financial Protection Bureau said: "The CFPB is concerned with data security, and companies are on notice that they'll be held accountable for shoddy practices. We expect that any firm follow the law, regardless of the technology used."

8. Book Tip - All-in on AI: How Smart Companies Win Big with Artificial Intelligence

The author of the business classic competing on Analytics and the director of Deloitte's US AI practice present a fascinating look at the pioneering companies utilizing artificial intelligence to forge new competitive advantages in this Wall Street Journal and Publisher's Weekly bestseller.

While most businesses are making modest investments in AI, there is a select number of world-class businesses that are betting big on the technology and fundamentally transforming their cultures, products, processes, and business models. Even though these businesses make up less than 1% of all large corporations, they are all leaders in their respective fields. Better business models, wiser choices, improved customer interactions, superior goods and services, and higher prices are all attributes of these companies.

Filled with insights, strategies, and best practices, All-In on AI also provides leaders and their teams with the information they need to help their own companies take AI to the next level.

“All-In on AI” gives executives and their teams the information they need to advance AI within their own organizations, as it comes with valuable insights, tactics, and best practices.

In Jan-2022 NL 243 a year ago we introduced Klaus Haller’s book on AI. You might check again our article here.

9. Termine & Events

- Mar. 19 – 22, 2023: Fintech Meetup, Las Vegas, USA

- Mar. 21, 2023: Stammtisch Young Professionals im Treasury, online event by Verband Deutscher Treasurer

- Apr. 13 – 14, 2023: EACT Summit by European Association of Corporate Treasurers, Brussels

- Apr. 16 – 19, 2023: Smarter Faster Payments, Las Vegas, USA (May 8 – 10, 2023: remote connect)

- Apr. 17 - 18, 2023: IFGS - IMPACT: Powering FinTech To Drive A Brighter Future For All, organized by Innovate Finance, London, UK

- Apr. 24 – 26, 2023: Transact: Business at the Speed of Payments, organized by the Electronic Transactions Association (ETA), Atlanta, USA

- Apr. 26, 2023: Empire Fintech Conference, organized by Empire Startups, New York

- May 1 – 3, 2023: American Banker Payments Forum, San Diego, USA

- May 10 – 12, 2023: Mannheim SLG-Finanzsymposium - Kongress für Treasury- und Finanz-Management

- May 16 – 17, 2023: ACT Annual Conference by the Association of Corporate Treasurers, Newport, United Kingdom

- May 16 – 18, 2023: The US Fintech Symposium, Orlando, Florida, USA

- May 25 – 26, 2023: Enterprise Risk Management & Resilience, Security, Insurance & Captives, Zurich, Switzerland

- Jun. 6 – 8, 2023: Money 20/20, Amsterdam

- Jun. 6 – 16, 2023 am Spitzingsee, Austria; SLG Seminar 5-Tage Lehrgang Aufbau einer modernen Treasury-Abteilung

- Jun. 19 – 21, 2023: Coupa Inspire EMEA 2023 in London

- Sep. 13, 2023: Swiss Treasury Summit Jahrestreffen Schweizer Treasurer, Rotkreuz (Zug/Luzern)

- Sep. 25 – 29, 2023 in Wien Austria; SLG Seminar 5-Tage Lehrgang Aufbau einer modernen Treasury-Abteilung

- Sep. 27 – 29, 2023: EuroFinance International Treasury Management, the world’s largest treasury event. Barcelona, Spain

- Oct. 18 – 19, 2023: Structured Finance in Stuttgart Kongress für Unternehmensfinanzierung und Treasury

10. From the Desk of Tomato, yes time flies…

As written in the introduction, uncertainty and the rapidly changing economic landscape continued in the first quarter of 2023. The same was the case with the weather. However, as pilots, we are used to adapting to weather changes. The ski season was short, so I was able to go snowboarding only twice.

I had planned a third weekend in the mountains to enjoy snowboarding and après-ski in style. Unfortunately, snow was lacking, and the weather was too damp and cold for mountain sports.

Here is my last impression of a day with son (Mathieu 31) and father in the Swiss Alps

Enjoy Martin and the Tomato Team