Tomato Newsletter No. 238 - July/August 2021

Your monthly resource on working capital, process optimization, and issues related to the world of corporate treasurers, IT professionals, and bankers!

This newsletter is bilingual, English or German, depending on the source. Cette fois aussi en français.

Introduction

The holiday season is just around the corner for many of us and additional concerns have started to arise: which countries can I travel to right now safely? Is a COVID-19 test needed during my journey? Most probably, 2021 will be the year of the “conscious traveler” and “digital nomads”. People will be more discerning about the journeys they go on, willing to be away from home for longer as many enjoy the benefits of remote working. At the same time, just as last year, in 2021 many will seek to stay closer to home. In 2020, 9 out of 10 Europeans took their holidays close to home, according to Euronews.

This month’s Catch-Up includes topics such as 2-Factor Authentication, FX Management, Global Payments, Cash & Digital Money, Competitive Countries, International Taxation, Finance Automation, Climate Change, and more.

Remember that for any challenge related to your financial issues, you can ask Martin Schneider for a discussion that will clarify it. Contact Martin via email or call +41 44 814 2001.

Contents

- 2FA and What to Do If You Lose Your Smartphone

- FX Management by HSLU and UBS: Gezieltes Absichern lohnt sich

- Five Things to Know About Global Payments

- Global Liveability Index and Most Competitive Countries

- Overcoming Reluctance in Finance Automation

- Cash or Digital Money? Article in EN, DE and FR

- International Taxation BEPS planned by OECD

- Book Tip: How to Avoid a Climate Disaster by Bill Gates

- Termine & Events

- From the Desk of Tomato

1. 2FA and What to Do If You Lose Your Smartphone

Most of our online accounts now require additional security measures and give us the option of setting 2-factor authentication (2FA) to help preventing unauthorized access to our accounts. However, every time a smartphone is being replaced, an incredible amount of time is spent on migrating to another phone. The migration cannot even be done by private assistants due to private keys/passwords. In some cases, one could spend a whole day migrating from one smartphone to another.

Well-known 2FA methods and transferring Apps to another smartphone:

- Photo-TAN issued by many banks > each PhotoTAN initialization letter needs to be recovered in your personal file (as Treasurer, these company data belong into a safe).

- App download again

- authenticate with login credentials

- get the initialization letter of that bank - SMS one-time passwords sent to the mobile phone number (less secure but very pragmatic) > non-time consuming, if the smartphone is not lost

- Software-based authenticators from Google or Microsoft etc. (they use a time-based one-time password algorithm), can be used for various logins, if supported by the provider, because they use all the same algorithm. Read the manual and have a backup plan ready

- Biometric authentication (which uses face, voice, or fingerprint recognition)

To make sure you’re safe, when you set up 2FA, check for a backup code/unique recovery code option, which is best to be stored offline. If you lose your smartphone, you can try calling your operator to transfer your old number over to a new phone. However, you’ll need a new SIM card and the entire process could take 1-2 days. Consider having another device dedicated for 2FA.

Further reading at GitHub.com or search for your suitable link on 2FA and recovering

2. FX Management by HSLU and UBS: Gezieltes Absichern lohnt sich

HSLU und UBS erarbeiten eine sehenswerte und lesenswerte Strategie zum Währungsabsichern. Nicht für einmaliges Exportgeschäft angedacht, sondern für das wiederkehrende regelmässige Absichern von Währungsschwankungen.

Lesen Sie weiter unter dem UBS Link in Video (20 Min) mit einer PDF Präsentation

3. Five Things to Know About Global Payments

Market disruption is increasing in the USD 1 trillion global financial services industry, according to the recent “McKinsey on Payments” report (McKinsey & Company, 2020). Demand for better products and services and increased digitization are putting banks under pressure. Here are five top standards that underpin the global financial system and support the industry’s transformation.

- Financial messaging

First published in 2004, ISO 20022, Financial services – Universal financial industry message scheme, is widely recognized as the standard of the future. - International Bank Account Numbers (IBAN)

International bank transfers work quickly and easily thanks to the universally agreed way of defining and coding international bank account numbers. - Business identifier codes (BIC or SWIFT code)

For over 30 years, the standard has been used to identify banks and financial or related institutions to facilitate automated processing of information for financial services - Market identification codes (MIC)

Trading on international stock exchanges such as the NASDAQ is possible thanks to MIC codes defined by ISO 10383, - Messaging in securities

Before standardization, messaging used in transactions between financial institutions was ad hoc and inconsistent, resulting in inefficiencies and the risk of errors.

Details at https://www.iso.org/news/ref2483.html

4. Global Liveability Index and Most Competitive Countries

In our June Tomato newsletter, we wrote about the cheapest places to live in Switzerland, taking into account the RDI indicator that assesses the financial attractiveness of Swiss cantons and communities as a home.

This time, recent data show another facet of living in Switzerland. The latest edition of the cites two cities in Switzerland in the top ten: Zurich and Geneva, which moved up to seventh and eighth positions. The index is created using data sets and assessments by experts and employees on site. Five categories are taken into account: stability, healthcare, culture, and the environment, the education system and infrastructure. The individual aspects are classified on a scale from 1 (intolerable) to 100 (ideal).

- Auckland, New Zealand (96.0)

- Osaka, Japan (94.2)

- Adelaide, Australia (94.0)

- Wellington, New Zealand (93.7)

- Tokyo, Japan (93.7)

- Perth, Australia (93.3)

- Zurich, Switzerland (92.8)

- Geneva, Switzerland (92.5)

Moreover, the 2021 edition of the Institute for Management Development (IMD) ranking places Switzerland in the first position as the most competitive country in the world. Sweden and Denmark come second and third in the ranking. A total of 64 countries were evaluated in terms of economic performance, economic policy, the efficiency of the economy and the condition of the infrastructure. Two-thirds of the data taken into account come from statistics and one-third is based on surveys of business leaders.

Details at IMD and read which Governments supported their economies the most.

Ziehen Sie Deutsch vor? IMD Lausanne bewertete 64 Länder hinsichtlich der Wirtschaftsleistung, der Wirtschaftspolitik, der Effizienz der Wirtschaft und des Zustands der Infrastruktur. Fünf Europäische Länder belegen 5 der besten 10 Plätze. Den ersten Platz belegte die Schweiz als das wettbewerbsfähigste Land der Welt. (Siehe Tabelle unten). Den Bericht dazu lesen Sie in der NZZ Login oder Leserdaten angeben ist möglich.

Mit Zürich und Genf sind zwei Schweizer Städte unter den ersten 10 lebenswertesten Städten der Welt. Der «Global Liveability Index» des Magazins «Economist» sieht «aber ganze drei Städte Australiens und zwei Städte in Neuseeland» weiter vorn. Das heisst: In der Südhalbkugel lebt sich schön und gut.

Auch hier lesen Sie den Bericht in der NZZ Login oder Leserdaten angeben ist möglich.

Die zehn wettbewerbsfähigsten Länder laut IMD. Kleine Volkswirtschaften sind klar führend!

* Singapore’s ranking: It has suffered significantly on an economic level during the pandemic, as it depends on the export and import of services and on people’s mobility according to the report

One minute intro video at the IMD Link.

5. Overcoming Reluctance in Finance Automation

Thomas Oschlisniok, Partner, Management Consulting, Finance Strategy & Transformation at KPMG, discusses the results of a recent study by KPMG on automation in finance departments.

Currently, despite the big hype about digitalization in finance, digital transformation is still progressing slowly. New technologies, such as Big-Data Analysis and Business Process Management (BPM) platforms, are only used in small scope applications. Most companies are still busy implementing the necessary pre-conditions for efficient digitalization (Master Data Management and Data Quality, standardization towards a homogenous systems landscape and the decommissioning of old legacy systems).

Other key findings:

- the distribution of automation technologies is largely unchanged since 2018

- there is very low interest in Business Process Management (BPM) platforms for finance process automation

- one-quarter of the surveyed companies use Robotic Process Automation (RPA) bots

- the majority of the surveyed companies made very positive experience with RPA

- however, many companies are disillusioned with the current bot-hype; some respondents report a high level of maintenance expenditures, RPA being considered as bridging technology

- cloud solutions and in-memory databases are enjoying growing popularity in accounting

- big data analysis tools and self-service reporting are currently only being tested in pilot projects

- Artificial Intelligence (AI) is hardly used

6. Cash or Digital Money? Article in EN, DE and FR

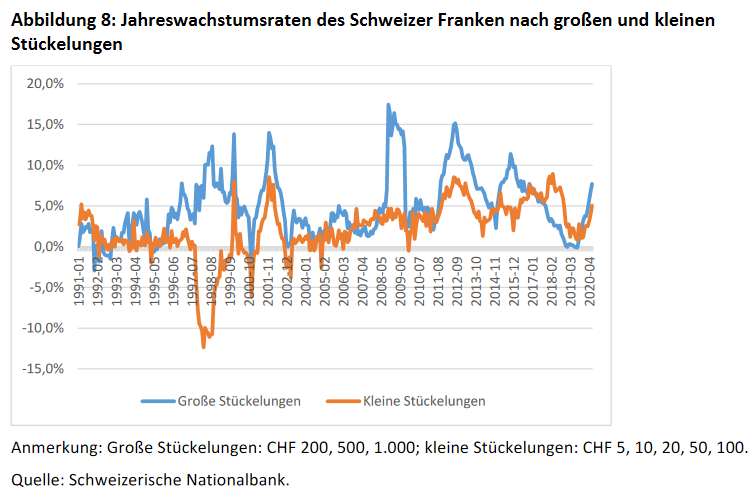

Some organizations call for the end of cash, others proclaim that cash has never been as plentiful as today. Some facts and projections:

Lockdowns have given credit and debit card payments and smartphone payments a boost with online and mail order purchases in the EU increasing by over 10% between March and September 2020 compared to 2019.

However, in uncertain times, the demand for cash seems to increase. For example, the volume of banknotes in circulation at the Swiss National Bank rose by 5.9% between March 2020 and February 2021 (an increase of CHF 131 billion). The same phenomenon can also be observed in the Eurozone and in the USA.

To combat illicit money circulation, many European countries have introduced caps on cash payments. According to Edoardo Beretta, economist and lecturer at USI, Lugano, plans to introduce central bank digital currencies (CBDC) are misguided from a monetary theoretical point of view since they ignore the relevance of the physical tangibility of money. There is a psychological component of cash that cannot be ignored. In addition, the temptation for central banks to expand the money supply would be even greater since there are almost no production costs for digital money. The fact that digital central bank money with negative interest rates would also open the way and become “Schwundgeld” (money that is secured in circulation and that loses value over time) is also not discussed.

Trust in a currency also jeopardizes new series of banknotes, especially if the old series loses its validity. The recently recalled eighth series of banknotes from the Swiss National Bank is no longer valid as a means of payment. The US is exemplary in this regard. Like Switzerland, they have never set an upper limit for cash payments while even dollar bills that were printed during World War I are still valid. Conclusion: Digital and physical money can and should coexist. While the former is ideal for online payments, cash is a good way to preserve value.

This text is translated from the link the DieVolkswirtschaft in German and French only

Ziehen Sie Deutsch vor?

Hygienemassnahmen haben 2020 Kartenzahlungen einen Schub verliehen. Zwischen März und September stiegen beispielsweise die Internet- und Versandhandelseinkäufe in der EU gegenüber dem Vorjahreszeitraum um über 10 Prozent.

Sind die Tage des Bargelds gezählt?

Gerade in unsicheren Zeiten scheint die Nachfrage nach Bargeld besonders gross. So stiegen die sich im Umlauf befindenden Banknotenvolumina der Schweizerischen Nationalbank zwischen März 2020 und Februar 2021 um 5,9 Prozent (Zunahme 131 Milliarden CHF). Das gleiche Phänomen lässt sich auch in der Eurozone sowie in den USA beobachten.

Bedenklich für den Fortbestand von Bargeld sind staatliche Regulierungen. Zahlreiche europäische Länder haben Obergrenzen für Bargeldzahlungen eingeführt. In Frankreich und Portugal liegt das Limit beispielsweise bei 1000 Euro pro Einwohner. Vorbildlich sind hingegen die USA, als auch die Schweiz: Sie kennen keine Obergrenze für Barzahlungen. In den USA sind sogar Dollarnoten, die im Ersten Weltkrieg gedruckt wurden, immer noch gültig. Die Schweizer Nationalbank erklärt dagegen relativ rasch alte Banknoten für ungültig.

Die Ostbayrischen Hochschule Regensburg erschuf diese sehr lesenswerte und spannende Untersuchung auf 24 Seiten

Mehr auf die Schweiz zugeschnitten ist dieser Beitrag der DieVolkswirtschaft Herausgeber ist das SECO

Est-ce que vous préférez le français ?

L’argent liquide a encore de beaux jours devant lui. - Le volume d’argent liquide a gonflé en Suisse durant la pandémie de Covid-19. Sa fonction d’instrument de réserve de valeur peut expliquer ce paradoxe apparent.

Lisez sous La Vie économique éditée par le Secrétariat d’État à l’économie (SECO)

Source of the following screens are from the PDF Hochschule Regensburg:

7. International Taxation BEPS planned by OECD

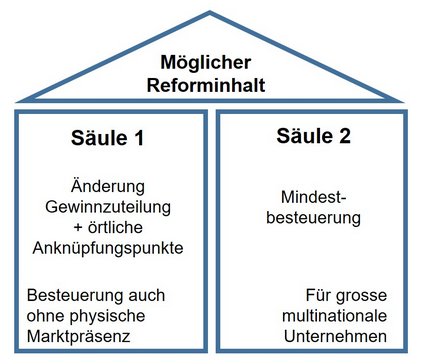

Under the OECD/G20 Inclusive Framework on BEPS (Base Erosion and Profit Shifting), 130 countries and jurisdictions are collaborating to put an end to tax avoidance strategies that exploit gaps and mismatches in tax rules to avoid paying tax. Check also https://www.oecd.org/tax/beps/

Am 1. Juli 2021 haben sich im Rahmen der OECD 130 Staaten auf faire Verteilrechte und im Unternehmenssteuerrecht auf einen einheitlichen Mindeststeuersatz von mindestens 15 Prozent geeinigt – eine echte Revolution im internationalen Steuerrecht. Das Konzept soll nun am 9./10. Juli beim Treffen in Venedig von den Finanzminister*innen der G20 beschlossen werden.

Lesenswerte Quelle vom Deutschen Bundesfinanzministerium

Das Schweizer Staatsekretariat für internationale Finanzfragen (SIF) beschreibt dies hier Diese folgende Darstellung ist auch vom SIF

Säule 1 sieht eine Verschiebung von Besteuerungsrechten in Marktstaaten vor. Unternehmen mit über 20 Milliarden Euro Jahresumsatz und über 10 Prozent Gewinnmarge müssen einen Teil ihres Gewinns im Marktgebiet versteuern. Dies dürften in der Schweiz weniger als eine Handvoll Grossunternehmen sein.

Säule 2 sieht einen Mindeststeuersatz von mindestens 15 Prozent vor für international tätige Unternehmen mit einem Jahresumsatz von über 750 Millionen Euro. Diese Umsatzschwelle übertreffen rund 200 Schweizer Unternehmen plus eine Vielzahl von Schweizer Tochtergesellschaften ausländischer Konzerne.

8. Book Tip: How to Avoid a Climate Disaster by Bill Gates

How to Avoid a Climate Disaster: The Solutions We Have and the Breakthroughs We Need by Bill Gates is based on a decade of studying the causes and impacts of climate change. With the help of experts in the fields of physics, chemistry, biology, engineering, political science, and finance, Gates has focused on what must be done in order to stop the planet's slide toward certain environmental disaster. In this book, he emphasizes the need to work toward net-zero emissions of greenhouse gases and what it takes to achieve this goal.

Gates further describes the areas in which technology is already helping to reduce emissions and points to the way in which the current technology can be made more effective. Moreover, he underlines the breakthrough technologies that are needed for net-zero emissions of greenhouse gases.

The pragmatic side of the book suggests not only actions governments should take, but also actions each individual can take to hold our government, our employers, and ourselves accountable.

9. Termine & Events

- 12.-15.7.2021: Fintech Week London, hybrider Event

- 20.7.2021: Benefits of a connected treasury: Achieving security, visibility and intelligence, Webinar

- 20.7.2021: ACT Webinar – The Value of a Post-Pandemic Treasurer

- 25.-28.7.2021: Payments Institute 2021, in Westin Alexandria Old Town, Alexandria, US

- 9.9.2021 ganztags: Swiss Treasury Summit 2021 von der Hochschule Luzern auf dem Campus Zug-Rotkreuz

- 28.-29.9.2021: ACT Middle East Treasury Summit 2021, virtueller Event

- 6.-8.10.2021: 35. Alpbacher Finanzsymposium, live Event

- 14.-16.10.2021: CEE 2021 Treasury Forum in Bratislava

- 20.10., 27.10, 3.11.2021 jeweils von 09:15-17:15 Uhr: IFZ Fachkurs Swiss Treasury Practice Aktuelle Herausforderungen im Corporate Treasury von Hochschule Luzern

- 17.11.2021: IACT Annual Treasury Management Conference 2021, hybrider Event in Dublin

- Ab 18.11.2021: Lehrgang Certified Corporate Treasurer VDT 2021 und 2022 (Verband Deutscher Treasurer).

Der Lehrgang umfasst vier Module à drei Tage, jeweils von Donnerstag bis Samstag sowie ein Modul à vier Tage, von Mittwoch bis Samstag, pro Seminartag acht Unterrichtseinheiten à 45 Minuten.

Der Lehrgang findet in den Räumen der Frankfurt School of Finance & Management, Frankfurt am Main statt.

Modul 1: 18.11. - 20.11.2021

Modul 2: 20.01. - 22.01.2022

Modul 3: 03.03. - 05.03.2022

Modul 4: 04.05. - 07.05.2022

Modul 5: 23.06. - 25.06.2022

10. From the Desk of Tomato

In the June issue of Catch-Up, we featured the interview “Krisen meistern – Gespräch mit Psychiater Bertrand Piccard” Sternstunde Philosophie SRF Kultur.”

Last week, I had the opportunity to meet Piccard in person at Zurich Airport. We had a lively discussion about environmentally responsible machines (cars and airplanes). Conclusion: We have to educate ourselves and adjust our lives towards a better, cleaner world.

In front of the Tomato windows, close to runway 28 of Zurich Airport where we observe daily what is happening at the airport.

It has been quiet for more than 12 months as Zurich Airport, like many other passenger airports, almost closed.

The daily visit of Airbus 380 from Singapore and Emirates was replaced by smaller planes.

For me, as an avid private pilot, it allowed me to fly more often from Zurich Airport with few or no restrictions on time slots. Airport controllers had few airplanes to guide but still operated.

Now, with the beginning of the holiday season, air traffic has increased. Emirates is again using the A380. Due to the many rainy and windy days, pilots choose to land direction west, which is favorable for us at Tomato, allowing great views from our office. See a short movie of the landing A380 on our site.

A recent special sighting: The Swiss National Football Team’s return from the UEFA Cup. Find a picture & movie depicting how the Swiss National Football Team was greeted by the Zurich airport authorities.

Enjoy your summer and your holidays – The Tomato Team