TOMATO CATCH-UP - Newsletter Issue 235 – March 2021

Your monthly resource on working capital, process optimization, and issues related to the world of corporate treasurers, IT professionals, and bankers!

This newsletter is bilingual, English or German, depending on the source.

Introduction

If you were wondering what the recipe for successful projects is at Tomato, we are happy to tell you. We have been involved in implementing sustainable solutions since 1992. From the start, we've always focused on just a few clients at a time to ensure that we' re able to serve each one with total focus.

A typical collaboration begins with a 75-minute workshop where we discuss the current situation and the solution we are seeking. Based on that, we develop a 3-5-page plan, review it with you, implement feedback where appropriate, and then create the order confirmation. We guide you through the project, working with your team as well as banks and providers who understand and appreciate our approach to coordination between stakeholders. We create manuals and software tutorials, compelling presentations for executive or board meetings. Regular progress reports allow both parties to have optimal control over the project status in relation to the final product. A debriefing follows immediately after the completion of a project. A follow-up on sustainability and profitability is conducted after 6 to 12 months. Visit our website to learn more about our approach.

Remember that for any challenge related to your financial issues, you can ask Martin Schneider for a discussion that will clarify it. Contact Martin via email or call +41 44 814 2001.

This month’s Catch-Up includes topics such as Treasury Management, Transfer Pricing, Pishing and Spear Pishing, Leadership and Recovery after the pandemic.

- Treasury Management Infrastruktur

- Virtual Coupa Bellin Roadshow – Review

- Vermehrte Cyber Angriffe im Home Office

- Transfer Pricing New German Guidelines

- Die Briten zeigen, was mit Open Banking alles möglich wird

- Information Phising and Spear Pishing

- Don't Cut Your Marketing Budget in a Recession

- Book Tip: Coronavirus: Leadership and Recovery

- Termine & Events

- From the Desk of Tomato

1. Treasury Management Infrastruktur

Die HSBC Studie zur Treasury Management Infrastruktur stellten wir erstmals im September 2020 Tomato Catchup vor.

Mit Rückblick auf das Corona Jahr 2020 wurde die Studie erweitert:

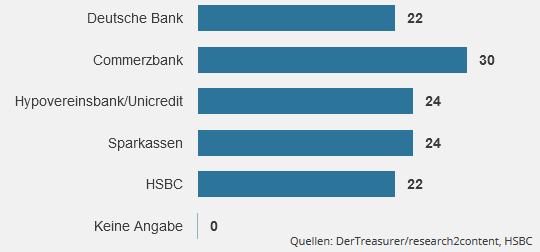

Für die Corporates in Deutschland sind alle grossen deutschen Bankinstitute wichtig. Bei kleineren Unternehmen unter 1 Mrd. Umsatz ist die Commerzbank leicht führend, wie aus dem Bild hier hervorgeht.

Bei grösseren Konzernen sind die Deutsche Bank und die HSBC die wichtigeren Banken.

Hier geht’s zur HSBC Studie Teil 2. Des Weiteren erfahren Sie in der Infrastruktur-Studie, welche Bank-Kanäle respektive Gateways zu den Banken am meisten genutzt werden.

Es ist dies vor allem der EBICS Kanal. Der Zahlungsverkehrs - Kanal (vor allem DACH Raum) ist einfach zu installieren, hat aber diese Handicaps:

- Lokale Format Dialekte wie DK-Format (DE) und Stuzza-Format (AT) verwendet werden. Das Format DT Ausland ist noch nicht in XML/ISO.

- Im selben EBICS-Gateway sind deshalb Länder in Süd- Ost- und Nord-Europa oder im fernen Asien kaum zu erreichen bzw. es wird komplex und setzt grösseres technisches Verständnis in der Treasury voraus. „Global EBICS“ könnte Abhilfe bieten.

- Im EBICS werden meist in jedem Zahl File die persönlichen Namen von leitenden Finanzmitarbeiter mitgegeben (wie z.B. CFO und Treasurer)

- Hin und wieder vernehme ich, dass der EBICS Kanal in der Europäischen Nacht unter Maintenance stehen kann, gerade wenn asiatische Töchter (der Europäischen Zeitzone voraus) den Kanal für ihre Zahlungen benötigen.

Der Vorteil vom Swift Kanal:

- Neben dem Zahlungsverkehr können weitere Daten wie FX-Geschäfte, Garantien etc. übermittelt werden;

- Ein einziges weltweites Zahlformat mit dem CGI Standard 001.001.03 vom ERP bis zur Bank.

Beachten Sie, SWIFT entschied nach umfangreicher Beratung um 2018 allen Crossborder Zahlungsverkehr bis 2025 auf ISO 20022 zu migrieren (Bericht engl. von Stephen Lindsay im TMI, mit Login). Das Thema werden wir im nächsten Newsletter besprechen; - Die Firmentransport-Unterschrift, auch Corporate Seal genannt;

- Blättern Sie wieder einmal in unseren Tomato-Slides „De-Zentrale Payment Factory“ oder bevorzugen Sie einen unverbindlichen kurzen Workshop zur Klärung Ihrer Fragen?

2. Virtual Coupa Bellin Roadshow – Review

The 1TC (Bellin client event) has taken place virtually, from March 2 to 4.

If you are a Bellin client (or a future one), you have received your login credentials. The roadshow was engaging because it was the first meeting after the Coupa takeover in May 2020. Also interesting was the speed and positive note with which Coupa began to change the Bellin world. To name a few changes, the move from yellow to blue, new software product names, email servers, and new client contracts are perhaps some of the most interesting changes. Moreover, Coupa will move all client data and servers to AWS (Amazon Web Services), the server and cloud provider worldwide. https://aws.amazon.com/de/what-is-aws/

The 1TC was a successful and very well coordinated event, given all the virtual corporate success stories and presentations. However, what I missed was a private chat room for visitors (or perhaps I didn’t notice it). At Structured Finance, the visitors were glad to discuss virtually, having a private place to exchange ideas and talk. As Coupa Bellin participant please use your Login credentials

3. Vermehrte Cyber Angriffe im Home Office

Die Umstellung auf Fernarbeit in weiten Teilen des deutschsprachigen Raumes ist für Cyberkriminelle ein gefundenes Fressen. Die Zahl der Angriffe auf Unternehmen, deren Mitarbeitende im Homeoffice arbeiten, ist seit Beginn des Vorjahres um 4516 Prozent gestiegen. Allein im Dezember gab es in Deutschland, Österreich und der Schweiz (DACH) im Durchschnitt 14,3 Millionen Attacken über das Remote Desktop Protocol (RDP) pro Tag. Also rund 166 in der Sekunde, wie IT-Sicherheitshersteller Eset mitteilt. Zum Vergleich: Im Januar desselben Jahres fanden noch 310'000 solcher Angriffe statt.

RDP - ein Protokoll für Windows-Geräte - ermöglicht den Fernzugriff auf Computer. Das Protokoll vereinfacht also die Arbeit aus der Ferne, bringt aber auch ein Sicherheitsrisiko mit sich: "Viele kleine und mittelständische Unternehmen sind für dezentrales Arbeiten nicht optimal aufgestellt", erklärt Thorsten Urbanski, Sprecher von Eset. Für die Verbindung mit einem RDP-Server sind lediglich ein Username und ein Passwort notwendig - ergattern Kriminelle diese Zugänge, können sie Daten stehlen oder Schadsoftware einschleusen.

Lesen Sie in Netzwoche den ganzen Bericht

4. Transfer Pricing New German Guidelines

In this KPMG article, Gerhard Foth and Andreas Wiesner write on the recently issued new Administrative Guidelines by the German Ministry of Finance regarding audits of Transfer Pricing matters. These Guidelines may impact all groups being present in Germany that are subject to Transfer Pricing legislation there. The Administrative Guidelines 2020 update earlier guidelines on Transfer Pricing and replace certain parts of the Administrative Guidelines 2005.

Important for taxpayers:

- Ensure that they have access to relevant evidence at the time of the audit;

- Maintain data and information that allows tax authorities to apply other Transfer Pricing methods than the one actually chosen;

- Information such as accounts ready for consolidation can be requested by the tax authorities;

- Emails, messages etc. can be requested by the authorities for a further “reality check” between the information given in the Transfer Pricing documentation and the actual conduct of the parties.

Topics relevant for the documentation preparation:

- The Guidelines introduce a “best method rule” (in the past, taxpayers had to apply “an adequate method”); one now also needs to justify why other methods have not been applied;

- German language of the documentation still seems to be very important, although, in practice, this is often handled in English;

- The increasing requirements to provide evidence and support to the “best method” come along with a reduced burden to estimate the income of a taxpayer.

Read the entire article on KPMG

5. Die Briten zeigen, was mit Open Banking alles möglich wird

Ein paar wenige Klicks in der Smartphone-App der Bank genügen – und schon lassen sich sämtliche Bankverbindungen auf einen Blick verwalten. Der Kunde hat eine einfache Open-Banking-Anwendung benutzt, um der App Zugang zu all seinen Konten zu erlauben. Sein Vorteil ist: er kann nun mit einer App binnen Sekunden Geldüberweisungen zwischen seinen Konten tätigen.

Solche Anwendungen waren in Grossbritannien nebst den Personal-Finance-Management-Tools (PFM) sowie den Apps, welche Zahlungen vereinfachen, die ersten Open-Banking-Anwendungen, die auf Zuspruch stiessen.

Lesen Sie den Bericht in der FinanzUndWirtschaft FUW

Wie steht es aus Sicht einer Schweizer Bank um Open Banking?

Als erste Bank der Schweiz erweiterte die Hypothekarbank Lenzburg ihr Kernbankensystem Finstar zu einer Open-Banking-Plattform und öffnete sich damit für Fintech-Unternehmen (Drittanbietern). Das ermöglicht den Lokalbank- Kunden aus der ganzen Schweiz zu gewinnen. Beim Thema Open Banking sieht die Bank-CEO Marianne Wildi die Schweiz der EU voraus, wie sie im Februar 2021 in einem Interview mit der Finanz und Wirtschaft (FuW) sagte. Die Bank lehnt sich hier so weit wie möglich an die Zahlungsrichtlinie PSD2 der EU an. Das Interview ist nur für FuW-Abonnenten vollständig zu lesen.

Details finden Sie deshalb hier im Bericht der Zeitschrift Cash

6. Information Phising and Spear Pishing

Phishing is the fraudulent practice of sending emails that appear to be from a reputable company with the goal of getting people to share sensitive information (login credentials, credit card information, bank account details, or other personal information).

Spear-phishing is a highly targeted form of phishing. Unlike a general phishing attack, a spear-phishing attack is personalized with specific details about the message's recipient.

Spear-phishing attackers gather personal information from social media accounts or the dark web to create messages that appear to come from trusted sources. They use these personal details to trick people into taking an action that could cause them to share even more personal information. Most frequently, the attacker suggests clicking a link or downloading software that contains malware or spyware, which could compromise personal and account information, potentially including financial and banking accounts.

Ziehen Sie Deutsch vor?

Bei Spear-Phishing handelt es sich um spezielle Betrugsversuche per E-Mail. Sie richten sich meist gegen konkrete Organisationen und zielen darauf ab, nicht autorisierten Zugriff auf vertrauliche Daten zu erhalten. Die Hintermänner bei Spear-Phishing sind nicht die üblichen Hacker, die willkürlich Daten abgreifen. Vielmehr geht es hier häufig gezielt um Finanzbetrug, Abschöpfen von Geschäftsgeheimnissen oder sogar militärische Informationen.

Aaron Ferguson, Gast-Dozent an der Militärakademie West Point und Experte der National Security Agency, bezeichnet das als den „Colonel-Effekt“. Um ihn zu verdeutlichen, versandte er eine Nachricht an 500 Kadetten und forderte sie auf, durch Klicken auf einen Link ihren Dienstgrad zu bestätigen. Scheinbar stammte die von Ferguson versandte E-Mail von einem Colonel Robert Melville aus West Point. Über 80 Prozent der Empfänger klickten auf den Link. In einer Antwortmail wurde ihnen daraufhin erklärt, dass sie einem Betrugsversuch aufgesessen waren.

Lesen Sie hier den ComputerWeekly.de Artikel. (Registrierung notwendig)

7. Don't Cut Your Marketing Budget in a Recession

It is a well-known fact that companies tend to cut marketing in a recession. However, according to two renowned professors of marketing, companies that maintain their marketing spending but reallocate it according to context - product development, advertising and communication, or pricing - fare better than those that cut their marketing investment.

Companies that have recovered strongly from previous recessions have generally not reduced their marketing spending, while some have even increased it. But they did change how they were spending their marketing budget.

Research in contexts as different as U.K. fast-moving consumer goods and U.S. automobile markets shows that products launched during a recession have both higher long-term survival chances and higher sales revenues. That’s partly because there are fewer new products to compete with, but it also comes from the fact that companies maintaining R&D have focused the investment on their best prospects — which may explain why products introduced during recessions have been shown to be of higher quality. Timing is also important. Research shows that the best period to launch a new product is just after a recession’s mid-point.

Read more details in the Havard Business Review

This article leads us to the Book Tip

8. Book Tip: Coronavirus: Leadership and Recovery

As the Covid-19 pandemic still impacts the global economy, forward-thinking organizations are moving past crisis management and positioning themselves to emerge even stronger from the crisis. “Coronavirus: Leadership and Recovery: The Insights You Need from Harvard Business Review" series provides you with essential thinking about managing your company through the pandemic, keeping your employees (and yourself) healthy and productive, and spurring your business to continue innovating and reinventing itself ahead of the recovery. Business is changing and the time to prepare and act is now.

The book comes with the introduction and practical case studies your organization needs to compete today and collects the best research, interviews, and analysis to get it ready for tomorrow.

Link to the book on Harvard Business Review Store

- 12.-16. April 2021, Five day event, Retail Banking Innovation Payments EU, virtual event, https://www.fintecnet.com/rbi-eu-2021

- 13. April 2021, Nachmittags ab 13.30 Uhr KPMG Digital Treasury Summit 2021 #DTRS

- 15. April 2021, 16h to 17.30 CET Commodity Trading Tax Webcast (Outcomes of OECD BEPS Project by PwC UK, Netherland and UAE

- 15. April 2021, European Digital Payments, virtual event, by ePay Summit

- 21-23. April, Mannheim: 32. Finanzsymposium von SLG, Wien wahrscheinlich virtuell

- 20. April, all day at 9 AM Singapore time CFO & Treasury Summit, by terrapin.com

- 15. Juni 2021, Cash Management Campus von DerTreasurer mit BNP

The Roaring Twenties and Now

The period between the end of World War I and the influenza epidemic toward the end of the 1910s and the 1929 stock market crash in the United States is known as "The Roaring Twenties." The 1920s were marked by enormous economic prosperity, and they left a distinct cultural imprint in the United States and Europe, especially in major cities. Full of hope and optimism, people consumed more than ever before, spurring an already booming economy.

There are strong similarities between the 1920s and the 2020s in that prosperity, the abundant flow of money, innovation and change characterize our times. Consumerism is stronger than ever.

The Roaring Twenties ended as a result of overconsumption, overspending, a weakness in the market, and overstretching of resources. All of this, coupled with a sudden stock market crash, led to the Great Depression.

Greed leads to wealth and luxury. "When we want too much, when we lose perspective, when we think we're too big to fail - that's when the greatest doom awaits us," says Aaron Schnoor, editor of Exploring Economics at Campbell University in an article The Roaring Twenties, Revisited.

The pandemic was a rude awakening as we realized how fragile our way of life is. Still, it was nowhere near as bad as the stock market crash of 1929. However, our lifestyles and attitudes resemble the Roaring Twenties and are worth reflecting on.

Scott Fitzgerald's The Great Gatsby is a quintessential representation of the Roaring Twenties or the Jazz Age, as Fitzgerald called it. Read a summary of the book or watch the YouTube trailer of the original movie with Robert Redford and Mia Farrow (5:35 mins)