Tomato Newsletter No. 265 - February 2024

Your monthly resource on working capital, process optimization, and issues related to the world of corporate treasurers, IT professionals, and bankers!

This newsletter is bilingual, English or German, depending on the source.

Introduction

Following the winter break, 2024 has gone smoothly for us. Swiss skiing competitions, tennis in Australia, and ice hockey have kept us in suspense. Depending on where you are, the already started Fasnacht provides a good distraction from the hustle and bustle of everyday life. All of this contributes towards a healthy work-life balance.

This month’s Catch-Up includes topics such as Days Payable Outstanding, Credit Suisse, Treasurer’s Role, Treasury Policy, Davos Highlights, Cyberattacks, Quality of Living City Ranking, Learning to Lead, and more.

Remember that for any challenge related to your financial issues, you can ask Martin Schneider for a discussion that will clarify it. Contact Martin via email or call +41 44 814 2001.

- EU-Regeln zum Zahlungsverzug

- Tomato-BBL 13.03.2024 in Bülach – ein BBL für Ihre Region?

- Die Rolle des Treasurer

- How to Write a Treasury Policy

- World Economic Forum 2024: Davos Highlights

- The Resurfacing Risk of Cyberattacks

- Quality of Living City Ranking

- Review Credit Suisse 2023 - Interview mit Bundesrätin Karin Keller-Sutter

- Book Tip – Call Sign Chaos: Learning to Lead

- Termine & Events

- From the Desk of Tomato

1. EU-Regeln zum Zahlungsverzug

Die Fachbegriffe Kreditorenlaufzeit, Lieferantenziel oder Days Payables Outstanding (DPO) wird der Zeitraum bezeichnet, den ein Unternehmen benötigt, um seine Verbindlichkeiten aus Lieferungen und Leistungen zu begleichen.

Die Richtlinie 2011/17 der Europäischen Kommission (in various Languages) zur Reduktion von Zahlungsverzug (vor mehr als zehn Jahren verabschiedet), zielte darauf ab, die Bezahlung von Rechnungen im B2B-Geschäft zu beschleunigen. 60% der Firmen werden später als 60 Tage der Höchstfrist bezahlt, insbesondere von Behörden. Kleine und mittlere Unternehmen (KMU) sollen geschützt werden, zu lange auf die Bezahlung einer Rechnung warten zu müssen.

Im Rahmen des KMU-Entlastungspakets am 12. September 2023 schlug die Europäische Kommission die neue Verordnung vor, die auf die Bekämpfung von Zahlungsverzug im Geschäftsverkehr abzielt.

Research und Anmerkungen von Martin Schneider:

Wir fragen uns a) Überagiert die EU? b) Ist dies angebracht? oder c) Werden Kreditoren mit der höheren Inflation und Unternehmens-Finanzierungskosten ab 2022 wirklich später bezahlt?

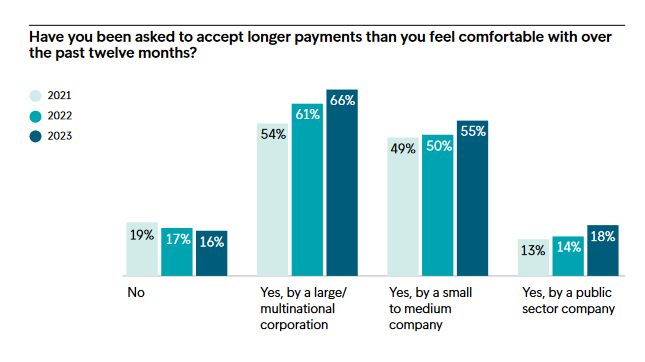

Wir untersuchten die DPOs in Europa und in Deutschland anhand des Intrum European Payment Report 2023 aus 10.000 Unternehmen in 29 Ländern. Grosse multinationale Unternehmen und der öffentliche Sektor verlangen längere Kreditorenzahltage, neu um 12% Punkte mehr Zahltage (Seite 13 des Deutschland Reports).

Intrum’s European Payment Report to download (you may leave your credentials name, position, company)

Intrum’s Deutschland Payment Report

Do you prefer English?

A report from the European Commission’s- German Representation states that the EU Commission is launching a public consultation to revise the rules on late payment.

Despite the current EU regulations on late payment, over 60 percent of companies in the EU are still not paid on time. Small and medium-sized enterprises (SMEs) are the most affected. This is why the EU Commission is planning to revise the existing regulations. It has launched a public consultation.

Research and comments by Martin Schneider: We wonder

- a) Is the EU over-aggressing?

- b) Is this appropriate? or

- c) With higher inflation from 2022, will creditors really be paid later (higher financing costs)?

We analyzed DPOs in Europe and Germany based on the Intrum European Payment Report 2023 from 10.000 corporates and 29 countries. Multinationals and the public sector appear to be demanding longer creditor payment days - 12% points more payment days (80% of German companies have been asked for longer conditions; page 13 of the Germany report).

Please find here a picture from the European-Report and Deutschland-Report. You may also search for your country.

2. Tomato-BBL 13.03.2024 in Bülach – ein BBL für Ihre Region?

Vielen Dank an die Treasury Kolleginnen und Kollegen für die Vorschläge für die BBL Gespräche.

Der nächste "Tomato Brown Bag Lunch" findet am Dienstag, 13. March 2024 in Bülach bei Vetropack statt. Wir freuen uns auf Teilnehmende der Region Zürich, Aargau und Umgebung. Die Teilnehmerzahl = circa 8 Personen aus den Bereichen Treasury Controlling, Finance.

Haben Sie Interesse von 12 bis 13.30 Uhr nach Bülach zu kommen? Die weiteren Details unter https://www.tomato.ch/brown_bag_lunch.html

Haben Sie Interesse an einem BBL in Ihrer Region? Gerne planen wir Lunch Gespräche bei Ihnen in der Region. Meine ersten Gedanken sind sicherlich Schweiz, Süddeutschland und Vorarlberg für Q2 / 2024. Interesse, Anmeldungen und wer gern Gastgeber sein möchte, meldet sich bitte bei Martin Schneider oder +41 44 814 2001. Besten Dank.

3. Die Rolle des Treasurer

Im Januar 2024 Catchup NL 264 berichteten wir über die Rolle des Treasurer. Wir linkten Sie als Leser leider auf die ältere 2017-noch-online-Version. Danke für Ihr Interesse am VDT-Bericht, dennoch ich entschuldige mich Ihre Zeit für einen alten Bericht genommen zu haben.

Die beiden Versionen 2017 (14-seitig) und 2023 (24-seitig) haben wir verglichen und bieten Ihnen hier die Änderungen bei der neuen 2023-Version:

Seite 6: Bankenpolitik mit Hinweisen zu Kernbankenpolitik und sich je nach Weltregion für einige wenige Banken zu entscheiden. Diese Entscheide sollen Zahlungsverkehr und Unternehmensfinanzierung beinhalten.

Seite 9: Hinweis zu Netting und Clearing

Seite 9: Online Shops mit e-commerce Lösungen mit Erfahrung zu PSPs, Akquirer und Zahlmethoden.

Tomato Hinweis: Nehmen Sie bei der Planung eines DE-Onlineshops die Zahlmethode PayPal mit. PayPal‘s Anteil in Deutschland ist circa 30%. Siehe Grafik der EHI Retail

Seite 10: Schadensvermeidung bei kriminellen Aktivitäten. Gute Prozesse, Sorgfalt und Menschenverstand. Klare Organisationsstrukturen.

Seite 11: In Finanzierung und Financial Asset Management ist die Kernbanken Strategie wichtig.

Seite 13: In Finanzierung sind ESG* Normen zu beachten (*ESG: Environment, Social, Governance).

Seite 16: Umgang mit Rohstoffen/Commodities.

Anmerkung Tomato: bei grösseren Preisfluktuationen innerhalb kurzer zeitlicher Abstände soll das Treasury (die Erfahrung vorausgesetzt) mit viel Feingespür und Expertise betroffene Abteilungen mit der Wahl von Absicherungsinstrumenten beraten und unterstützen.

Seite 17: Hedging ist die Kernfunktion des Financial Risk Management.

Seite 20: Treasury Organisation: Das Treasury übt im Unternehmen Support-Funktionen aus. Version 2017 Treasury ist handlungsorientiert.

Seite 22: Treasury&IT: Intensive Erfahrung nötig, auch IT übergreifend mit Banken und Systemanbietern

Seite 23: Treasury&IT: Stetige digitale Optimierung, Business Analytics, Künstliche Intelligenz

Weiter bei VDT scrollen Sie nach rechts unten und auf Download klicken

Das VDT PDF «Rolle des Treasurers» direkt speichern

Do you prefer in English?

Unfortunately, we published an older link from VDT The German Treasury Association in our January News. Please find above the points which differ from 2017 to 2023 publication. The checklist is similar to the list on our website in Tomato Publications

4. How to Write a Treasury Policy

After “The Role of the Treasurer”, how to write a treasury policy follows logically.

The treasury policy is the executive management's mandate to the treasurer as the guardian of financial risks. By clearly articulating treasury objectives and covering core components such as hedging strategy, it is designed to provide more predictable outcomes and should gain buy-in from other stakeholders.

TMI's latest guide describes the steps to creating a purpose-driven financial policy and putting systems in place to ensure compliance.

The treasury policy clarifies expectations for treasury when interacting with potential clients. Certain treasurers appear to find it difficult to clarify the specifics of hedge policies, referring to them as "industry standard."

An out-of-date policy is a waste of time and effort. Furthermore, it is a missed opportunity to inform internal and external stakeholders:

- How financial risks affect a company's capacity to survive

- The importance of the Treasury's function and duty in controlling the effects of financial risks

- The significance, obligation, and role of stakeholders in aiding Treasury in accomplishing its goal of managing financial risks

The 21-pages guide can be downloaded for free at TMI (you have to log in or share your details to receive the PDF).

Find a quick view of our Tomato suggestions and contact Martin Schneider +41 44 814 2001.

5. World Economic Forum 2024: Davos Highlights

The World Economic Forum held its 54th Annual Meeting in Davos from January 15–19, 2024, under the theme Rebuilding Trust.

More than 100 nations, all of the main international organizations, 1000 Forum Partners, leaders and specialists from civil society, representatives of the young, social entrepreneurs, and media outlets were present at this year's meeting.

Here are some highlights and contributions covering topics related to our business from experts in their respective fields:

- Leaders need to 'pull together' for global cooperation and security.

- Projections are not destiny: A new model for growth.

- Humans are going to have better tools: AI: Opportunities and challenges.

- Urgency is our only savior: Tackling climate change and building new energy systems.

Must Read:

- The real impact of Davos 2024: Key outcomes on AI, climate, growth, global security and more

- Cybersecurity and supply-chain resilience: How to future-proof the factories of tomorrow

- Recession, conflict, or climate crisis? Which risks are top of the agenda, by region

- Davos trade insights; What you need to know about global trade this month

6. The Resurfacing Risk of Cyberattacks

From KPMG: Due to years of natural growth, cloud connectivity and system integrations with other parties, email architectures have become highly vulnerable to cyberattacks. From 333.2 billion emails exchanged globally in 2022. Where 6.1% to 11.2% malicious. These figures have increased significantly each year.

Due to decades of organic growth and recent tight integration with internet-based systems, email architectures have become increasingly vulnerable to attacks. In particular, impersonation and internal Denial of Service attacks are on the rise. In 2022, 333.2 billion emails were sent worldwide. Depending on the source, 6.1% -11.2% of these are malicious. There has been a sharp increase in these numbers year on year. In the meantime, 97% of all companies have been attacked by means of malicious emails.

Email security covers more than just messages that are received via the internet, even if the threats presented by emails should not be taken lightly. Think about the dangers connected to the following:

- Email infrastructures that are outdated, susceptible, and readily exploited;

- Internal emails in which the recipient implicitly trusts the sender;

- Emails sent by business-critical apps using outdated infrastructure are not encrypted;

- Apps from uncontrolled third parties (like SaaS) that send emails on behalf of a business using its email domain;

- Social engineering attack risks, such as those associated with lookalike domains;

- Risks associated with an organically developed architecture that connects numerous, dissimilar systems (cloud, on-premises, hybrid, etc.) and outside suppliers over a long period of time.

Read more on the KPMG blog.

7. Quality of Living City Ranking

With a second place ranking in Mercer's prestigious Quality of Living City Ranking for 2023, Vienna is first placed. Zurich has once again demonstrated its appeal to people worldwide. Several variables are considered in the ranking, including infrastructure, sociocultural environment, healthcare, education, and political stability.

Germany has three cities under first rankings Frankfurt, Munich, Dusseldorf and Switzerland two cities with Zurich and Geneva. Down under comes up also with three cities.

Zurich's excellent score is indicative of the high standard of living, urban innovation and scenic beauty, which combine to create a unique way of life. This enables a lifestyle that strikes a balance between career achievement and personal well-being, especially when combined with an excellent public transportation system and first-rate healthcare.

Ranking from 1 – 12:

Explore and read about your city or the entire Ranking of 240 cities worldwide. Scroll down on the Mercer link below.

Read more about the ranking on Mercer’s website.

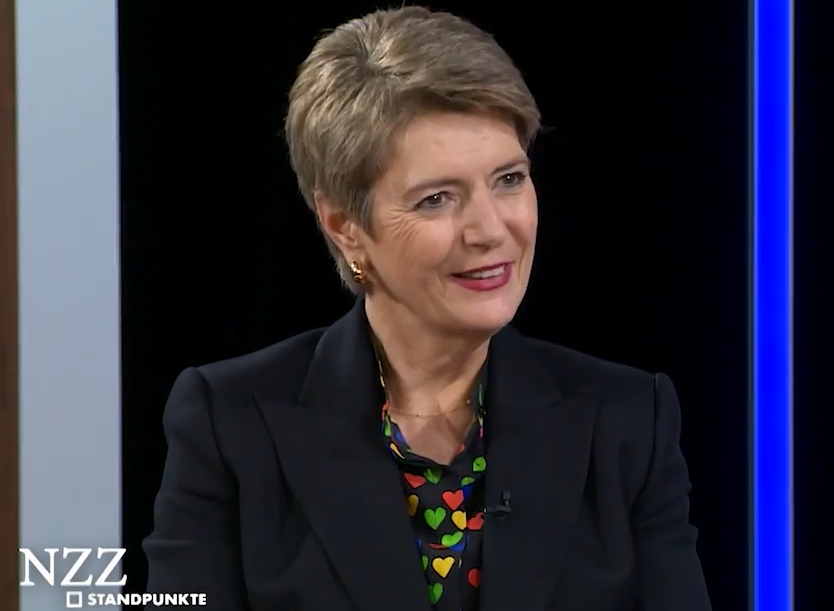

8. Review Credit Suisse 2023 - Interview mit Bundesrätin Karin Keller-Sutter

In "NZZ-Standpunkte" spricht die Schweizer Bundesrätin Karin Keller-Sutter (Finanzministerin) über das Ende der Credit Suisse im März 2023 und die Folgen für die Schweiz und international. Durch das Interview führt Eric Guyer, Chefredaktor NZZ.

Schlüsselfaktoren für den Niedergang der CS und die Übernahme der UBS aus Sicht KKS:

- Probleme bei US Regionalbanken greifen auf das nächste schwächste Glied.

- Bisheriger Hauptinvestor, die Saudi National Bank, beteiligt sich nicht mehr an der CS.

- Mitte März 2023, in ihrer letzten Woche, hatte die CS Tages-Abflüsse von 10 bis 17 Milliarden CHF.

- Rating Agenturen sprechen “non-invest” aus.

- Erste Aufgabe: den Schaden für die Schweiz und ihre Wirtschaft abzuwenden.

- Respekt vor einem Dominoeffekt

- Wirtschaftliches Scheitern der CS-Unternehmensführung, die Alarmzeichen nicht gesehen hat.

- Die betroffenen Parteien erreichen eine Stabilisierung der Situation.

- Seit 2009 40 Mrd. Boni versus 800 Mio. Gewinn – gehört Leistung und Verantwortung zusammen?

- Krisen halten sich nicht an Drehbücher

Lesen Sie das Interview mit Scrollen unterhalb des Video mit Eric Guyer oder und hören Sie das 50-minütige Video auf NZZ.

Do you prefer English?

In the "NZZ Viewpoints" of March 2023, Federal Councillor Karin Keller-Sutter (Minister of Finance) talks about the demise of Credit Suisse and the resulting consequences the entire country.

NZZ-Article and video in German:

9. Book Tip – Call Sign Chaos: Learning to Lead

Call Sign Chaos tells the story of American military veteran Jim Mattis, from leadership positions in three wars to eventually leading a quarter of a million troops in the Middle East. In the process, Mattis narrates his formative leadership experiences, concluding about the nature of warfighting and peacemaking, the value of allies, and the current strategic conundrums that confront the USA.

Three sections make up Mattis' book: Strategic Leadership, Executive Leadership, and Direct Leadership. Mattis recounts his early experiences leading Marines into combat in the first section. In the second section, he delves into what it means to be in charge of thousands of soldiers and how to modify your approach to guarantee that your intentions are understood. In the third section, Mattis outlines the difficulties and strategies faced by military leaders in their efforts to balance the human desires of political leaders with the harsh reality of battle.

In the end, Call Sign Chaos is a narrative about developing a distinctive leadership philosophy that applies to everyone. It is also a journey about learning to lead.

10. Termine & Events

- Feb. 26, 2024: ACT Treasury Briefing Saudi Arabia, Riyadh, KSA

- Feb. 26 – 28, 2024: Identity & Payments Summit by Secure Technology Alliance, Tucson, USA

- Feb. 27 – 28, 2024: Finnovate Europe: Cutting-edge Fintech Innovations & Impactful Connections for Accelerated Growth, London, UK

- Mar. 3 – 6, 2024: FINTECH Meetup, Las Vegas, USA.

- Mar. 6, 2024: ACT Cash Management Conference, London, UK

- Mar. 6 – 7, 2024: MoneyLive Summit, London, UK

- Mar. 12 – 14, 2024: Merchants Payments Ecosystem, Berlin, Germany

- Mar. 18 – 19, 2024: Bank Automation Summit, Nashville, USA

- Mar. 19, 2024: FTT Lending 3.0 - Powering the Future of Lending, London, UK

- Mar. 19 – 20, 2024: Pay 360 Conference, London, UK

- Mar. 19 – 20, 2024: Global Treasury Americas – Gearing treasury for growth, San Jose, CA, USA

- Mar. 25 – 28, 2024: Merchant Risk Council - MRC Vegas, Las Vegas, USA

- Apr. 2 – 3, 2024: Future Digital Finance, New Orleans, USA

- Apr. 16, 2024: Instant Payment & Fraud Management Summit, New York, USA

- Apr. 17, 2024: Digital Tranformation in Banking & Insurance Summit, New York, USA

- May 6, 2024: IFINTEC Finance Technologies Conference and Exhibition, Istambul, Turkey

- Oct. 2 – 4, 2024: EuroFinance International Treasury Management, Copenhagen, Denmark

11. From the Desk of Tomato

I recently came across an article about the Pomodoro Technique which is a time management method developed by Francesco Cirillo in the late 1980s. Its purpose is eat procrastination and improve your focus one pomodoro at a time.

It uses a kitchen timer to break work into intervals, typically 25 minutes in length, separated by short breaks. Each interval is known as a pomodoro, from the Italian word for tomato, after the tomato-shaped kitchen timer Cirilloe. The original technique has five steps:

- Decide on the task to be done.

- Set the Pomodoro timer (typically for 25 minutes

- Work on the task;

- When the timer rings, take a 5 minute break;

- Every 4 pomodoro’s, take a longer break (15 to 20 minutes)

Feel also free to use an online timer which I found here https://www.tomatotimers.com/

We are delighted that our brand Tomato appears in a variety of fields.

image: "Pomodoro [day 61]" by gerlos is licensed under CC BY-ND 2.0

Enjoy your break – Martin and Tomato Team