Tax Landscape in Switzerland in Accessible Map-Based Information

Would you like to compare taxes in various locations for companies and/or private individuals? You can use the PwC tax comparison tool to do just that.

Individuals’ relevant tax rates are determined by their place of tax residency and taxable income. The tax rates of the Swiss cantons can be compared at three different income levels: CHF 100,000, CHF 250,000, and income subject to the marginal tax rate.

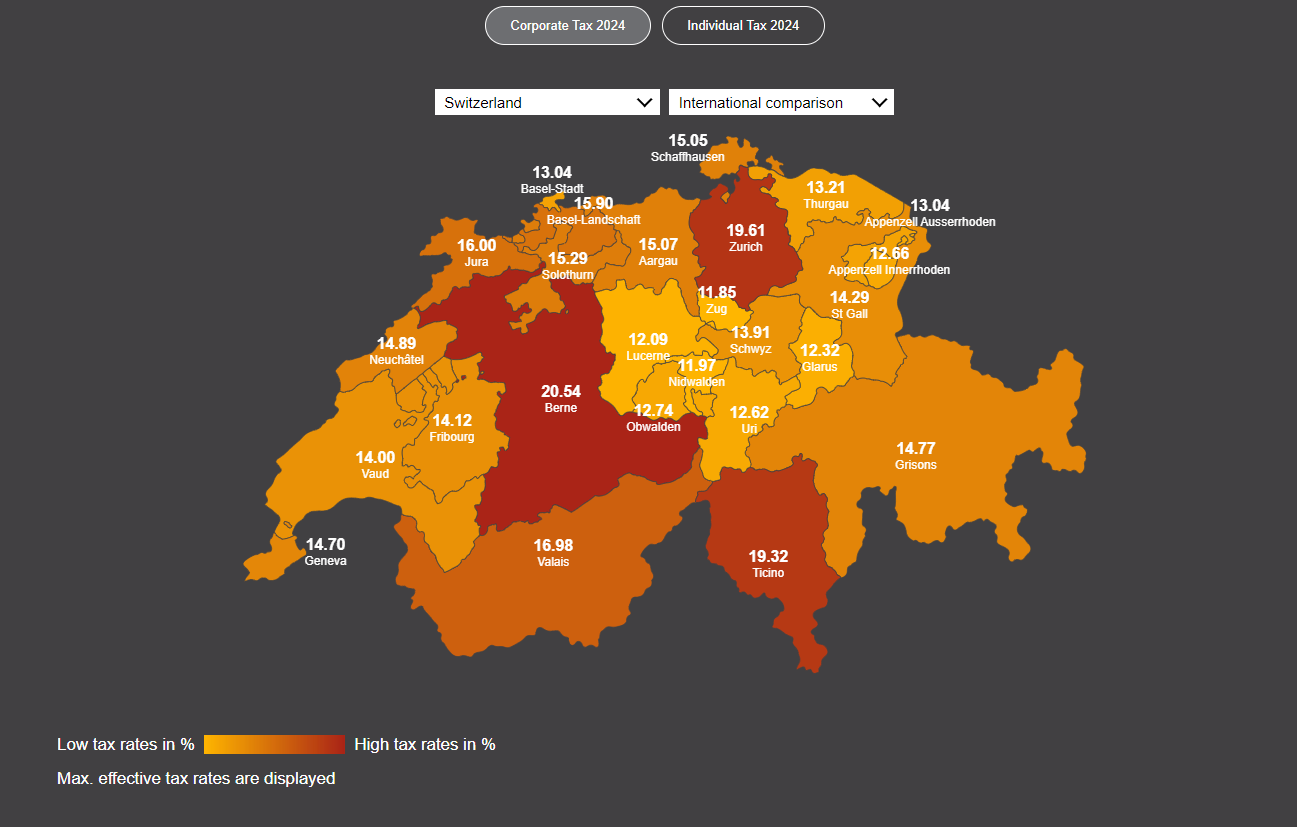

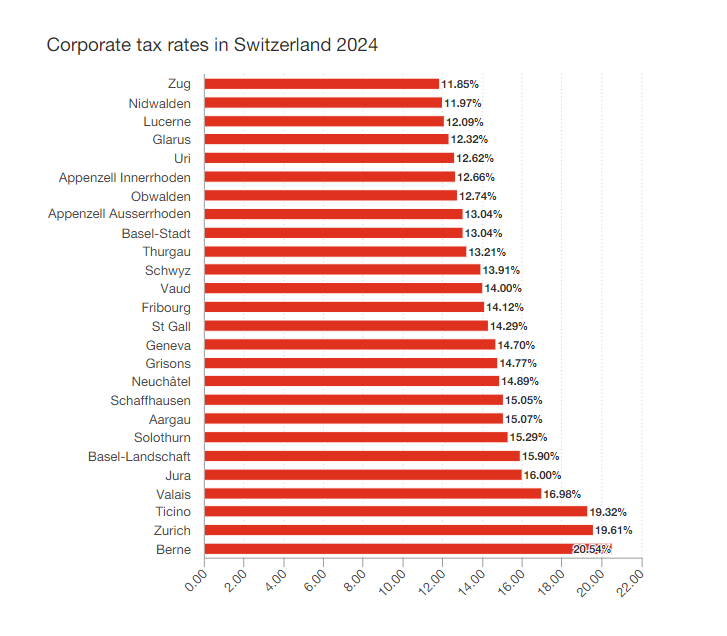

When it comes to corporate tax, you can compare effective rates beyond Switzerland. Corporate tax rate comparison focuses on the ordinary corporate tax rates and does not include considerations around the OECD minimum taxation rules. The latter are only relevant for multinational groups with a consolidated annual revenue of at least EUR 750 million.

The tax rates for each canton’s capital are displayed on the map of Switzerland bellow. The interactive map lets you create your own comparisons.

Read more on PwC’s blog and use the date for your company or also for your private data