Supply Chain Finance as a Module Inside a TMS?

By Martin Schneider

20 to 30 years ago, a TMS was able to transact FX, interest rate transactions, single manual treasury payments, its reporting with MT940 for a financial status and liquidity planning, netting, guarantees. Usually, today there are also mass payments with all the user rights, audit trails, and many other things.

Will Vendor Finance themes a module of a TMS? Or also fraud detection?

Is it important to include supply chain features in a TMS as a module? I guess yes.

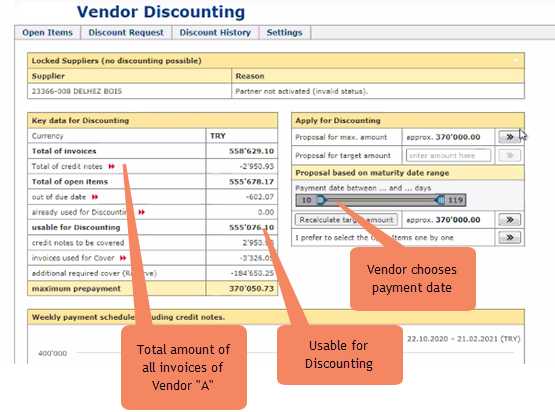

Recently, I joined a session of a local Swiss Vendor Financing Tool, which is implemented and runs at a bigger corporation as internal browser software. Each local entity of that corporate has the feature to deal with its local supplier and local banks into that Vendor-Finance-System. Once pre-negotiated with suppliers and banks, basic data are set up by the Group Treasury, then local suppliers and local banks can use their data within their contract area and in a way that allows the supplier to choose his own payment date.

Would it make sense to include such a system in a TMS? Can this be the future?

Are you interested in learning more about this excellent software tool? Ask me at martin.schneider@tomato.ch or +41 44 814 2001, see screen below.

Listen to the podcast at TreasuryManagement.com where Coupa and Bellin discuss the TMS-future – Donna Wilczek, Coupa Software, François Masquelier, Simply Treasury, and Martin Bellin, BELLIN.

The podcast is 33 minutes long; due to the length to listen, it is unfortunate that the podcast has no minute-agenda-indication to flip to a preferred theme.